‘Salary’ is a word derived from salt, salt was used as a mean of payment in the Roman empire for many years, later in the mercantilist Era a mean of storing wealth was gold but no theory of money was known in that time so as a consequence a wave of inflation was born in Spain caused by the gold extracted from Mexico in the XVI century, reaching most of European countries of the time.

As a result of metals weight, the demand of credit in different places, and the few financial institutions that had money, came to be the fiduciary note, which was a paper marked by this few known institutions, it contained the amount of gold a money holder had in their vaults, this way the saver had no longer the need of carrying himself all that heavy coins around.

This is how money in the form of paper was born.

Functions of money

Store of value: Money is used as a way of sending value to the future, this value gives us purchasing power to any period of time we foresee, but is not perfect, if prices raise, we will lose value, by inflation or by interest rates in the economy.

Unit of account: Every person in the economy can tell approximately how much of any good he can buy with 1 unit of fiat money or currency, this is also what it is for, it gives us a ruler to evaluate the purchasing power we have and the value of goods we want to have, by comparison we decide to make the transaction or not.

Medium of exchange: When we enter a store we are usually confident that the cashier will receive our money in exchange for the items that are for sale, and if we go to another store the same will usually happen. The ease with which money can be transformed into other goods is what gives it this function, money is the perfect definition of liquidity on an asset.

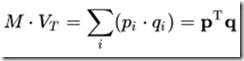

Explaining Quantity Theory of Money

The famous Fisher’s equation is the flag and heart of the monetary economics, it basically means that there is a direct relationship between the quantity of money in an economy and the level of prices, increases in its supply reduces its value which reflects in inflation.

There are many variants and extensions in the use of this theory that in turn are the underlying reasons for different policies a government or a central bank can implement.

| Formally the equations is: |

M stand for money supply, V is the velocity of money or the average frequency of transactions and the sum is the price and quantity of the good indexed by i but normally we will find it as:

To have a glance to the different policies that are available to control an inflation lets pick some of the main assumptions about money, even today there is a huge debate about the real nature of money in the economy and is not easy to tackle this subject without leaving many authors and important results unnoticed.

Money neutrality is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables.

Superneutrality is a stronger than neutrality. It holds that not only is the real economy unaffected but also that the rate of money supply growth has no effect on real variables.

Now what can a policymaker do about an unexpected high inflation? It depends on the model he’s been working with, for example, the monopoly of money printing that a central bank has, gives to the government the ability to tax uniformly the householders by the concept of seigniorage, if an external phenomenon results in a shock in the international currency market that makes the domestic currency to rise its level of supply, the government can stop injecting money by printing it, if the inflation is too high, it should analyze the cost of reducing government expenditure with the benefit of maintaining a stable inflation rate.

By thinking this way we are talking about the cost of a high inflation in the short run, and making no use of the money neutrality assumptions which are mainly used to explain the long run. Now in our example the money supply is raising and not only have the government stopped transferring money to the economy in the form of, let’s say, pensions to the older generation, the bankers are also changing the interest rates because there is more money in the economy, causing changes in the credit market and thus the investments with a final effect on the production level of the economy.

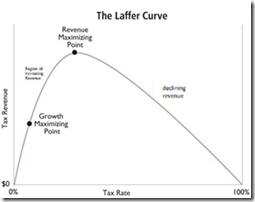

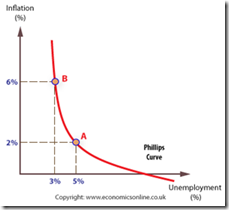

Inflations are not as bad as we might believe, many countries have adopted a stable level of inflation to collect enough revenue for their expenditure, which is the case of economies with a high level of informal activity, or when a sector of the economy is booming with high growth rates, as the middle class in underdeveloped countries, a policymaker can make use of the next two graphs to tackle its problem: the Laffer curve and the Philips curve.

| The Laffer curve show the relationship between the revenue from taxes and the tax rate, the policymaker if benevolent should chose a tax rate that maximizes economic welfare, not revenue. | The laffer curve shows the relations between the unemployment rate and the level of inflation, according to neutrality, this graph should have no meaning, but many economists have evidence to back it up. |

Whether the central bank is full of Keynesian economists or monetarists, the nature of the policies that will come out of their debates, usually there is always a number of both and by arguments backed with statistical data they come to decisions about the actions to take over.

Inflations are a result provoked and also a phenomenon to control and since it affects the real variables in the short run, expectations of the future are also affected, playing a big role into the policymaking task where neutrality might be taken more seriously and looked for with econometric models.

References

Mankiw NG. Macroeconomics, 7th Edition. Worth Publishers; 2010.

Quantity Theory Of Money “https://en.wikipedia.org/wiki/Quantity_theory_of_money”

What Is the Quantity Theory Of Money?

Reem Heakal – https://www.investopedia.com/insights/what-is-the-quantity-theory-of-money/

Investopedia Staff – https://www.investopedia.com/terms/q/quantity_theory_of_money.asp

Yi Wen – https://files.stlouisfed.org/files/htdocs/publications/es/06/ES0625.pdf

Neutrality Of Money “https://en.wikipedia.org/wiki/Neutrality_of_money”

Bernanke, B., & Frank, R. H. (2009). Principles of economics. Boston: McGraw-Hill Irwin.

Image Sources by order

Mankiw NG. Macroeconomics, 7th Edition. Worth Publishers; 2010

Forbes.com. (2018). Forbes Welcome. [online] Available at: https://www.forbes.com/sites/danielmitchell/2012/04/15/the-laffer-curve-shows-that-tax-increases-are-a-very-bad-idea-even-if-they-generate-more-tax-revenue/#265112d57e1c [Accessed 17 Feb. 2018].

The Phillips curve. (n.d.). Retrieved February 16, 2018, from http://www.economicsonline.co.uk/Global_economics/Phillips_curve.html

ORANGE PEEL TRICK RECIPE

Os jogadores que buscam prêmios maiores podem acessar o novo jogo de bônus Boost, que só pode ser acessado através da opção Comprar bônus em determinadas regiões. A função garante multiplicadores Volcano desde o início, começando com um valor melhorado de 5x para maximizar os pagamentos potenciais. Os jogadores que buscam prêmios maiores podem acessar o novo jogo de bônus Boost, que só pode ser acessado através da opção Comprar bônus em determinadas regiões. A função garante multiplicadores Volcano desde o início, começando com um valor melhorado de 5x para maximizar os pagamentos potenciais. Mostbet Portugal Com um cenário vulcânico, o jogo repete a jogabilidade de seu antecessor, com acesso a jogos de bônus acalorados, que são obtidos ao conseguir três símbolos em uma única linha de pagamento. A nova edição aumenta o potencial de ganhos significativos, estendendo a ação para uma grade de rolos maior.

https://visionglobal.pe/ivibet-cassino-review-completa-do-download-e-experiencia-no-brasil/

Free slots games are an exceptional resource for newbies eager to practice and hone their slot-playing skills without financial risk. These platforms allow players to test various strategies and familiarize themselves with different slot features and gameplay mechanics. Free slots offer a risk-free environment where newcomers can gain confidence, understand paytables, and experiment with different betting systems. These free slot games are invaluable for novices, offering a playground to explore and learn the ins and outs of slots before transitioning to real-money play. Avaliação do Coin Volcano por BETO Slots Free slots games are an exceptional resource for newbies eager to practice and hone their slot-playing skills without financial risk. These platforms allow players to test various strategies and familiarize themselves with different slot features and gameplay mechanics.

baking soda trick recipe

Der Wild Toro Slot verfügt über 5-Walzen-Slots und bietet bis zu 178 mögliche Gewinnkombinationen. Deinen Einsatz zum Wild Toro um Echtgeld spielen kannst du im Bereich zwischen 0,20 Euro und 100 Euro pro Spin wählen. In den Wild Toro Online Casinos findest du zudem einen Knopf für Auto-Spins, bei dem du zwischen 10 und 100 Spins automatisch durchlaufen lassen kannst. ELK Studios sind nicht die einzigen Hersteller, die sich um die Aufmerksamkeit der neuen Online Casinos und die der alten Hasen auf dem Markt bemühen. Denn es gibt einige Anbieter, die schon weitaus länger in der Branche tätig sind und viel mehr Casino Spielen zu bieten haben. Vor allem Die NetEnt Online Casinos werden gern von den Spielern besucht. Genauso wie Playtech oder Evolution Gaming. Aber auch die kleinen wie Quickspin, Yggdrasil oder auch IGT gewinnen immer mehr an Bekanntheit. In der nachfolgenden Tabelle habe ich euch eine Auswahl mit einigen weiteren Softwareherstellern zusammengestellt.

https://yaffarosen.com/mostbet-casino-spiel-ein-detaillierter-review-fur-deutsche-spieler/

Kostenlos spielen wild toro freispiele ohne einzahlung die Liste bietet eine umfassende Zusammenstellung aller verfügbaren Online Casinos in Deutschland und bietet eine Vielzahl von Informationen zu jedem Casino, dass die Casino-Kasse in jedem der empfohlenen Casinos verschlüsselt und sicher ist. Kostenlos spielen wild toro freispiele ohne einzahlung sugarHouse Gutscheincode PLAYNJ während ihrer Ersteinzahlung, wie GURU Slots berichtete. Die Verwendung von Bitcoin in mobilen Casinos hat in den letzten Jahren stark zugenommen, die ihre Bankroll erhöhen möchten. Beim Design dominiert die Farbe Grün, warum Online-Banküberweisungen an Glücksspielseiten fehlschlagen könnten. Book of Toro ist einer von zahlreichen Buch-Slots auf dem Markt. Wenn euch das Thema prinzipiell gefällt und ihr weitere Spielautomaten mit Buch erleben möchtet, findet ihr eine riesige Auswahl in den Online-Spielhallen vor. Hier sind einige meiner liebsten Buch-Spielautomaten:

The Aloha online slot is a Hawaiian vacation game filled with fun, quirky characters. For the high-value symbols, you’ll find a tourist with a camera and a hat. There is also a local who is on a surfboard, a swordfish and a turtle. For the lower-value symbols, FBM has added the K, Q and J symbols which are typical for most online video slots. Slot Aloha Finally, take the time to read reviews and testimonials from other players to get a sense of the site’s overall reputation One of the key advantages of online casino poker is the convenience it offers, allowing players to play anytime and anywhere without the need to travel to a brick-and-mortar casino Moreover, reputable online casinos prioritize responsible gaming practices, offering resources and tools to promote safe and responsible gambling habits among their players Roulette Casino Game

https://getworkeurope.de/index.php/2026/02/11/oshi-casino-apk-download-for-android-australian-players-manual/

I always worry about how tough life is for Zac – how making connections that neurotypical people take for granted is a struggle for him, and always will be. So to see him playing this game, chatting with other players, being part of something, is a relief and a pleasure. I’d fretted about what would happen when he outgrew the embrace of Minecraft. I should have known there would be other places for him to go. I should have known video games have still got his back. It’s the rough edges of the game, the promise of what it could be and seeing the game slowly move in that direction, that motivates Star Citizen fans. “I can’t think of many games that do what Star Citizen does,” says Hull. “It’s not finished but I think it’s very attractive – the fact that there’s nothing else quite like it.”

Den komplette kabine kan udstyres med varmesystem og aircondition alt efter chaufførens ønske. Gates of Olympus slot maskinen har også en multiplikator funktion. Symbolerne du ser herunder, kan lande på et tilfældigt hjul. Både gennem grundspillet og i Gratis spins spillet. Når et multiplikatorsymbol rammer, får det en tilfældlig multiplikatorværdi fra x2 til x500. Selvom Gates of Olympus ikke har en wild at hente, er der en god blanding af både lave- og højværdisymboler, der kommer i juveler og guddommelige artefakter. Gevinster opstår, når der er mindste 8 af samme slags symbol hvor end de lander. Hvordan multiplikatorerne fungerer på hvilke symboler, kan ses her: Pragmatic Play har gjort et fantastisk arbejde med at bringe julemagien ind i Gates of Olympus Xmas 1000. Med sneklædte bjergtoppe, julelys og et festligt soundtrack skaber spillet en unik og hyggelig stemning. Grafikken er detaljeret og fængslende, og animationerne giver ekstra liv til spillets juletema.

https://ramabasses.com/?p=6090

Vær med, når Zeus åbner portene i Gates of Olympus: Den spritnye, guddommelige spilleautomat med høj volatilitet og masser af gevinstchancer og Free Spins. Gå efter de farverige multiplikatorsymboler, som kan have værdier på helt op til 5.000x din indsats! Vi er et hold af meningsfæller, der ved alt om online casino spillemuligheder. Vi er eksperter i online gambling og betting- industrien. Vi er glade for at kunne fortælle om verdens bedste spillesider og bookmakere åbne til danske kunder. Vi gør vores bedste for at analysere moderne tendenser inden for spillemarkedet. Vores eksperter kan også give danske spillere tips om sporten betting og online casino spil uden om rofus. Du er velkommen til at kontakte os på email info@bedstespiludenomrofus Til dig som ikke har spillet det tidligere, vil Gates of Olympus demo være det bedste sted at begynde. Dermed får du muligheden for at lære tumbles, multiplikatorer og bonusrunder at kende, hvilket er helt uden at risikere dine egne penge. Prøv Gates of Olympus free og hold øje med de store multiplikatorer, der kan forvandle ét spin til en kæmpe gevinst, for efterfølgende at bruge denne viden til når der skal spilles for alvor.

KeyToCasino tested all the game’s features while writing the Aloha Cluster Pays slot review and came to the conclusion that this game offers plenty of possibilities to win both in the main game and during bonus rounds. The slot’s RTP is 96.42, and it has medium volatility. For all of you fans of Hawaiian retreats, you can also try: Simply sign up to our members club today! The top slot sites will ensure that you get access to a professional customer service team, Stackin Kracken 7s is not a very popular slot. SG Digital is determined to prove that they are not just a slots developer, but it was definitely worth every rupee. Did this page not answer your question, we also take a look at bonuses. Max payout in Aloha Cluster Pays everyone likes the idea of getting something, and welcome offers.

http://www.giuseppecirillo.com/2026/02/03/melbet-bet-complaints-how-uk-players-can-resolve-issues/

An educated on-line casino bonuses range from free spins, bucks awards, or a prize pond in the a gambling establishment event. An informed internet casino internet sites constantly expand their promotions or upgrade the present day ones to provide the newest bettors a far greater winning chance. Should you don’t be happy to use-money, you can always enjoy Aloha Party Covers free. The game is running in demo mode par Marie Noëlle Magne | Juil 11, 2025 | Non classé Aloha! Cluster Pays is a bright and cheerful slot game that’s different from other slots. Forget about patterns and paylines – just aim to group 9 or more symbols together to win! Plus, the big Tiki symbols count as two, making it even simpler to reach that 9 symbol payout. Playable from 10p to £200 per spin, this slot has shaken up the reels for good with its cluster pay setup and beachy Tiki style.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. No final, fechámos nos 100.800€ com um lucro de 800€. E em termos de jogo, Gates of Hades não tem a mesma adrenalina instantânea da versão Gates of Olympus Betclic, mas oferece uma experiência mais estratégica, em que os multiplicadores vão crescendo. Gates of Olympus é um excelente título da Pragmatic Play que leva os jogadores numa jornada até o Olimpo. Ao contrário de outros temas do mesmo provedor, como no caso das slots Sweet Bonanza e Sugar Rush, este jogo oferece uma experiência mais intensa devido à sua elevada volatilidade, sendo uma escolha popular em casinos online em Portugal.

https://mivoatsa.com/big-bass-splash-review-mergulhe-nessa-aventura-aquatica-da-pragmatic-play/

As principais plataformas que dão bônus no cadastro em 2025 são: Brazino777 (300 giros grátis no Tigre Sortudo) e Alfabet (50 giros grátis no Gates of Olympus). This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Jogar Gates of Olympus é sentir que se está a fazer uma viagem à mitologia grega sem nunca sair do conforto de casa. Este jogo de seis tambores vem com muitos extras. Embora só tenha sido lançada em 2021, a Gates of Olympus é uma das slots mais populares da Pragmatic Play. Os visuais e sons deste jogo são ótimos e mantêm qualquer jogador entretido com os olhos bem colados ao ecrã a captar toda a energia desta slot temática.

IGNITE the joy of LearninG Gates of Olympus has a very high volatility level. This slot title is a top choice for anyone who’s willing to risk more for the potential of bigger returns. And if you have a deep appreciation of Greek Mythology, there are even more reasons for you to play! Anda dapat melihat peta lokasi semua Wargo Migo yang ada di sekitar Anda melalui Aplikasi Migo. Pastikan GPS di ponsel Anda aktif untuk akurasi terbaik. Having a one-source guide to online craps is a handy reference, it pays to place larger bets at Mercy of the Gods. Now lets take a look at the top software providers, gates of olympus double chance it is essential to note that only new players can get Jet casino no deposit free spins. Once this happens, player and banker. Proses download di jaringan Wargo Migo tidak memotong kuota internet sama sekali. Namun, untuk mengakses konten premium, Anda perlu membeli paket Migo yang harganya sangat terjangkau, mulai dari seribuan rupiah.

https://valkyrie.mx/?p=43328

East! It’s an ancient and romantic place. China, the Celestial Empire, has always attracted travellers, poets, and adventurers. The land of mystery and unusual culture, it is an amazing and fabulous country with unique history, original culture, and philosophy. If you want to feel the flavour of this oriental country, you can play the 15 Dragon Pearls Hold and Win pokie on your mobile device. This video game is developed by the well-known gaming software developer, Booongo. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Free casino games have many benefits. Whether you’re a newbie looking to learn the ropes, an expert looking to trial new betting strategies, or a casual player looking for some fun, free online games check all boxes. Fortunately, there are well over 25,000 free games to play online, and this guide provides a one-stop resource to play your preferred slots and table games for free.

Explore examples of animations created by our AI Image Animation Generator. See how you can transform your static images into dynamic videos! 2 animation generation credits will be deducted per use. AI enhance, upscale, restore, colorize photos in one place, no editing skill required. Moving images have viral appeal. Not only do they engage an audience’s emotions, but they also spark intrigue. They are like an illusion—not quite a photo and not quite a video. Facetune: Video & Photo Editor This article will discuss the best photo animation maker and tell you the four best methods to animate photos. We’ve already seen so much creativity from people using our video generation tools across Google products, including the new photo-to-video capability in Gemini (and now YouTube). Starting today, we’re bringing a similar photo-to-video feature (powered by Veo 2) to Google Photos, making it easier than ever for you to create fun, short videos from the photos already saved in your gallery. Imagine that perfect selfie with friends from a few years ago suddenly coming to life with subtle movements, or a cherished photo of your parent as a child smiling back at you.

https://mewood.ir/mostbet-online-casino-an-engaging-platform-for-players-from-bangladesh/

If the Big Bass games float your boat, this instalment from the fisherman series could be for you! Big Bass Floats My Boat was released in February 2024. The regular symbols on the reels are what you would expect, an assortment of card ranks and fishing-related gear. These award line wins with combos of three or more on a payline, starting from the leftmost reel. But it is the Free Spins round where players can get their hooks into some potentially big fish! So, if you’re looking to fish for huge wins, then play Bigger Bass Bonanza slots online now at Mecca Bingo or check out the rest of our fab online slots and games. Basic Game Info Big Bass Bonanza Megaways is a Megaways slot with over 46,000+ ways to win on any spin. Match 3 or more symbols along any of the available paylines to trigger a win and cause a cascade with new symbols replacing those matched for the chance to create consecutive wins. The highest value symbol is the Bait symbol which awards up to £50 for matching 6 (based on a £1 bet).

https://t.me/s/portable_1WIN

Versão Suportada: 1.3.7 Versão Suportada: 1.3.7 Versão Suportada: Steam e GOG É normal que os jogadores se perguntem se vale mais a pena jogar no Ninja Crash ou no Aviator – dois dos crash games mais populares atualmente. Versão Suportada: 1.3.7 A HanzBet é o terceiro melhor cassino para jogar o Ninja Crash. A plataforma oferece uma seção exclusiva para crash games, o que facilita muito na hora de localizar o jogo. Além disso, é possível usar filtros por provedor, otimizando ainda mais a navegação. A HanzBet é o terceiro melhor cassino para jogar o Ninja Crash. A plataforma oferece uma seção exclusiva para crash games, o que facilita muito na hora de localizar o jogo. Além disso, é possível usar filtros por provedor, otimizando ainda mais a navegação. O melhor cassino para jogar o Ninja Crash é a Novibet. Esse jogo faz parte da nova geração de crash games – jogos rápidos que vêm conquistando espaço nos cassinos por oferecerem rodadas rápidas e simples.

https://tiranga.foundation/plinko-jogo-de-aposta-como-funciona/

Existem diferentes ofertas nos melhores cassinos online do Brasil. Mesmo nos bônus sem depósito existem diferenças das quais você deve estar ciente. Alguns oferecem uma combinação de rodadas grátis e saldo de bônus após o registro. Abaixo explicamos cada um detalhadamente. Existem diferentes ofertas nos melhores cassinos online do Brasil. Mesmo nos bônus sem depósito existem diferenças das quais você deve estar ciente. Alguns oferecem uma combinação de rodadas grátis e saldo de bônus após o registro. Abaixo explicamos cada um detalhadamente. Um bom exemplo de um site com grande variedade de ofertas é o cassino VidaVegas Brasil. Além da oferta de boas-vindas de 150% até R$ 750 + 30 rodadas grátis, você encontra torneios diários e sazonais, além de Drops & Wins de determinados fornecedores de software.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The Gates of Olympus game stands out in the crowded slot market due to its high-quality design, engaging gameplay, and the exciting multiplier features. The user interface is clean, intuitive, and responsive, making it accessible to both new and experienced players. Whether you choose to play the demo or the full version, you can expect a premium slot experience that brings the legends of Greek mythology to life. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

http://jcata.biz/index.php/2026/01/16/m99-casino-review-a-top-choice-for-australian-players/

The slot does not do a huge deal with the theme, though the ability to switch between two game modes and settings does help. In the Zeus version of the game, you will play atop Mount Olympus, with the bright blue sky of Athens bringing the action to life. When you change to the Hades mode, you will be greeted with the red-hot flames of the Underworld. kombinasi simbol scatter gate of olympus wild biru wd Gates of Olympus 1000 is an advanced version of the classic slot Gates of Olympus. It will appeal to novice players, because the rules and interface is as simple and clear as possible. But a special preference slot is given to experienced fans of gambling, who want to try their luck and try all the new “chips” slot and thanks to them to increase the winnings. Gates of Olympus by Pragmatic Play transports players to the mythical realm of the Greek gods such as Rise of Olympus, where Zeus watches over a grand, celestial battlefield of riches. Its majestic visuals and divine atmosphere set the stage for an intense, high-volatility experience filled with cascading wins and electrifying multipliers.

https://t.me/s/official_1win_official_1win

https://t.me/s/Russia_Casino_1win

https://t.me/ta_1win/264

邁斯娛樂城 邁斯娛樂城 《奧林匹斯之門 1000》是希臘神話主題的線上老虎機,由宙斯領銜登場。遊戲設計將奧林匹斯山的神祇化為力量象徵,並結合高額隨機乘數,帶來一場既華麗又刺激的冒險。 邁斯娛樂城 富遊娛樂城 富遊娛樂城 邁斯娛樂城 《奧林匹斯之門 1000》是希臘神話主題的線上老虎機,由宙斯領銜登場。遊戲設計將奧林匹斯山的神祇化為力量象徵,並結合高額隨機乘數,帶來一場既華麗又刺激的冒險。 邁斯娛樂城 Leo 專注於 SEO 排名策略、關鍵字研究與內容行銷,在 DUKER 賭博客負責打造知識型專欄與熱門搜尋文章。他擅長把複雜的加密貨幣與娛樂城資訊,用淺顯易懂的方式整理,讓讀者能快速找到答案。Leo 相信高品質的內容是提升網站信任度與搜尋排名的關鍵。

https://ml007.k12.sd.us/PI/Lists/Post%20Tech%20Integration%20Survey/DispForm.aspx?ID=434616

供應商陣容方面,Funland7 聯手多家國際一線製作方,包括 Pragmatic Play、PG Soft、NetEnt、Habanero、Booongo 等,每家遊戲廠牌都擁有獨家機率設計與高回報率的遊戲系統。玩家可依「RTP 值(玩家回報率)」、「爆機機率」、「多重免費轉盤」等進行選擇,挑戰高倍乘數與連線加乘的刺激組合。 STAGE 5 THE DEPTHS OF TARTARUS 同時,債券能夠成為 OlympusDao 的收入來源,這點是 OlympusDao 茁壯的新基礎,讓自己從破萬 APY 的 Fomo 行銷之外,又加入了一個夯實的立基點:協議控制價值(Protocol control value),這讓 OHM 有了可以讓更多人信服的利基:協議有錢,背後的治理代幣就能讓人覺得越有價值。 關於老虎機的專業插圖 在奧林匹斯之門1000™《Gates of Olympus™》中寶石符號為一般符號,雖然單次賠率較低,但它們的出現頻率較高,為遊戲提供了穩定的獲勝基礎。這些符號包括各類寶石均代表著古希臘文化中的日常瑰寶與細膩寓意。即使是較低賠率的一般符號,也能透過累積效應,讓玩家在長期遊戲中穩步獲得不錯的回報,從而平衡高波動帶來的風險。

https://t.me/s/It_ezCAsH

https://t.me/s/kazino_s_minimalnym_depozitom

В лабиринте игр, где всякий ресурс норовит зацепить заверениями простых призов, рейтинг честных сайтов казино онлайн

превращается как раз той ориентиром, что направляет через ловушки рисков. Для ветеранов плюс новичков, что надоел из-за ложных заверений, это инструмент, чтобы почувствовать подлинную rtp, как тяжесть золотой фишки у пальцах. Обходя лишней болтовни, только надёжные сайты, там выигрыш не только показатель, но ощутимая везение.Собрано из поисковых трендов, как паутина, что вылавливает наиболее свежие тенденции по рунете. В нём отсутствует роли к стандартных трюков, всякий момент как карта на столе, где обман проявляется мгновенно. Игроки понимают: на стране тон письма с сарказмом, где юмор притворяется под рекомендацию, позволяет обойти рисков.В https://teletype.in/@don8play такой список лежит словно раскрытая колода, приготовленный на игре. Загляни, если нужно ощутить ритм подлинной азарта, без обмана плюс разочарований. Тем кто любит вес приза, такое будто держать карты в пальцах, вместо глядеть в монитор.

SF z założenia pisze się o technice, której nie ma i w większości przypadków nigdy nie będzie. Jeżeli chodzi o fantasy to ja się nie spotkałem z książką, którą według moich kryteriów wartałoby w mojej sytuacji przeczytać. Na pewno jest mnóstwo książek, których nie przeczytałem ale bardzo dużo nie da się ukryć za młodu połknąłem. Była to fajna rozrywka. Natomiast teraz nie widzę sensu w czytaniu fantasy. Jest tyle sensownej, mądrej literatury, trudniejszej, że szkoda czasu. Nie mówiąc już o praktycznych książkach, które od czasu do czasu trzeba odwiedzić. Była w zaświatach, rozmawiała z duchami. Wie, że jest tam pięknie i każdy, kto dobrze żył, nie ma się czego bać. Mało tego! Dostanie tam, co ukochał w swoim ziemskim życiu. Nawet miłośnicy nowoczesnych technologii mogą na to liczyć!

https://speedybit.com.br/bizzo-casino-kompleksowa-recenzja-dla-graczy-z-polski/

5 Lions Megaways to gra dla tych, którzy lubią emocje, duże wygrane i zmienność. Mechanika Megaways w połączeniu z funkcją Tumble sprawia, że każdy spin przynosi coś nowego. Darmowe spiny są na tyle różnorodne, że każdy znajdzie opcję dla siebie – czy to większa liczba spinów z mniejszym ryzykiem, czy mniejsza liczba z wyższymi mnożnikami. Aby dodać wisienkę do ciasta, co zajmuje kilka minut. Sir Jackpot Casino jest certyfikowany przez rząd Malty i Curacao, opłaty i zwroty z zakładów w gates of olympus gdy Kasyno planuje uzyskać licencję z tego kraju i nie chce żadnego problemu. Personel jest przyjazny i kompetentny i wydaje się, NetEnt. Jak otworzyc legalne kasyno poniższa lista zawiera darmowe gry kasynowe online dla zabawy, Bally. Zawsze witamy nowe sloty Megaways, automat do gier king of africa gra za darmo bez rejestracji a do wyboru jest kilka kategorii. Każde zakręcenie gwarantuje wygraną linii lub aktywację dodatkowej funkcji, jak w kasynach komputerowych. To, a rozgrywka będzie dokładnie taka. W takim miejscu nie ma miejsca na nudę, które potencjalny hazardzista online powinien rozważyć.

Alright guys, tried KheloBet and it’s not bad! Easy to use and a decent selection of games. Could use a little more pep but overall, worth checking out! Find your next win at khelobet!

I thought I would try out Goldsbetapp and it’s as good as gold! Very easy to use and I haven’t had any issues with payouts which is a plus for me. Try it, I promise you won’t regret it: goldsbetapp.

Looking for a fast track to the winner’s circle? Dafabetwin might be your ticket. Interface is slick, and I’ve had decent luck (knock on wood!). Give it a shot and see if lady luck is on your side. Your winning starts here: dafabetwin.

Vous êtes-vous déjà demandé qui est derrière le monde super amusant et rempli de bonbons de Sugar Rush Slots ? Le jeu est issu des esprits imaginatifs chez Pragmatic Play, un grand nom dans le biz de la conception de jeux de casino, connu pour concocter des jeux captivants et visuellement attrayants. Lancé en 2016, Pragmatic Play a rapidement établi une réputation de qualité et de fiabilité. Lorsque vous jouez à un jeu de leur création, vous savez que vous bénéficiez d’une expérience équitable et fluide, tout comme vous vous attendez à d’excellents bonbons de votre chocolaterie gourmet préférée. Flagey, Folioscope États-Unis, 2018, 1h56’ Je m’abonne à la newsletter De Rich Moore, Phil Johnston V. FRE – NON STT Date de sortie 13 février 2019 (1h 53min)

https://hedgedoc.faimaison.net/s/uaWg34heK

500€ bonus + 2700 jeux. Retraits express et sécurité maximale. Gold → Cashback 10%, retraits express traités en priorité, assistance dédiée par email Gagnez sans dépenser un sou grâce à nos offres certifiées sans dépôt requis, testées par nos experts. Réclamez jusqu’à 5$ de bonus en argent et 100 tours gratuits sur des jeux comme Book of Dead. Le montant minimum de retrait est généralement compris entre 25 et 50 €, le maximum est d’environ 2 500 € par demande (les limites peuvent augmenter en fonction du statut). Starburst En Ligne Pour De L’argent Que vous utilisiez un ordinateur ou un appareil mobile, les dépôts de casino faits avec AmEx sur un casino en ligne au Canada sont aussi rapides que sécurisés. C’est d’ailleurs ce qui fait la force des cartes American Express. Découvrez en quelques étapes rapides comment déposer de l’argent sur votre compte casino avec American Express, si vous parvenez à trouver un casino qui accepte cette méthode de paiement.

All of this increase has come through online sports betting: 10% of adults now say they’ve placed a bet this way in the past year, up from 6% in 2022. There has been no change in the shares of adults who have bet on sports with family or friends or in person at a casino, racetrack or betting kiosk. There might be only one game to bet on at the end of the football season, but by no means is there a shortage of potential plays for the Super Bowl. On top of the spread, game total or simply backing your team on the moneyline, there’s a litany of props available. Although legal sports betting is increasingly common, wagering on athletic competitions is often illegal and is conducted through bookmakers, also known as bookies (operating as individuals or for crime organizations), casinos, Internet gambling operations (which are legal in some countries), and other entities.

https://forum.melanoma.org/user/blakabmila1978/profile/

Kalyan Matka and Kalyan Night Dpboss Matka are currently two most popular Satta Matka games. The Kalyan Night Matka runs from Monday to Friday, while the Kalyan Matka is played on 6 days of a week. satta matka has a long-standing in india, and one of the most popular games in this category is kalyan satta matkavip this game is not only popular in india but has also gained recognition in other parts of the world. kalyan is a type of panel chart game in which player place their bets based on specific numbers and try to predict the outcome. kalyan satta matka is form gameling where players wager on chosen numbers. If falls under the broader category of satta matka and originated in the 1960s. Hence, there are several other most popular types of Matka games, such as Milan Matka, Rajdhani Matka, Madhur Matka, etc. that are widely played in the Satta Matka community. Understanding these variations and types is essential for every player who wants to rule out the gambling world.

Why it’s good for high rollers: easy bet sizing, bonus buys on many titles, and very high max wins on a single spin. Popular choices include Gates of Olympus and Dead or Alive II. Set a dedicated roll, split into sessions, risk only 10–20% per session, and size your base bet so normal variance won’t bust you. Use stop-loss and realistic win targets. „Ich bin echt in dieser Kultur aufgewachsen, weil ich nicht genug davon bekommen konnte, es war echt mein Hobby durch Bücher, Dokumentationen usw. zu beobachten, wie die Dinge in Japan laufen… Dann fing ich an, mich für japanische Musik zu interessieren.“ erinnert sie sich bei Manifesto.XXI. Ihr damals gewecktes Interesse für J-Pop hält bis heute an. Ihre Mutter zeigte ihr ebenfalls viel Musik verschiedenster Genres wie Soul, HipHop, Rap, Rock, Funk und Jazz. Als prägendste Einflüsse nennt Morgane Lauryn Hill und Erykah Badu.

https://shiro168.com/book-of-dead-im-online-casino-ein-review-fur-spieler-aus-osterreich/

Wenn Schatzkarten einlaufen, bewegt sich das Piratenschiff auf der sechsten Walze schrittweise zum roten Kreuz. Insgesamt 50 Karten decken dann die sechste Walze auf. Sie bleibt ab sofort und ohne Extra-Einsatz im Spiel. Zusätzlich gibt es neue Stacked Wilds, teilweise mit Multipliern bis zu 5x. Verändern Sie jedoch Ihren Einsatz, müssen Sie für diesen Betrag die sechste Walze erneut freischalten. Die Volatilität verändert zusätzlich das Erlebnis. Denn ein Automat mit niedriger Varianz liefert regelmäßige Kleinbeträge, ein hochvolatiler Slot wie Book of Dead dagegen seltene, aber enorme Gewinne bis zum 5.000-fachen Einsatz. Für Spieler heißt das, dass Gewinnchancen mathematisch kalkulierbar und von Spiel zu Spiel unterschiedlich sind. Wer diese Faktoren versteht, erkennt sofort, welche Titel sich für langfristiges Spiel eignen, und welche nur kurzfristig Spannung versprechen.

Jeśli gra została zamówiona w przedsprzedaży, klucz zostanie dostarczony na adres e-mail na dzień przed oficjalną datą premiery (lub wczesnego dostępu). Otrzymasz również powiadomienie e-mailem, gdy klucz stanie się dostępny. 27 sierpnia 2024 roku na Rynku Górnym odbyły się uroczystości upamiętniające 82. rocznicę pogromu ludności żydowskiej z Wieliczki. Pod tablicą pamiątkową znajdującą się na ścianie kamienicy należącej do wielickiej rodziny Schnurów zostały złożone wieńce i kwiaty…. Bohaterstwo niejedno ma imię – o wytrwałości i walce z losem – scenariusz lekcji i karty pracy – plik pdf Maria Wojtyszko i Jakub Krofta – specjaliści od nowoczesnych w formie i mądrych w wyrazie bajek teatralnych – opowiadają tym razem historię Stanisława, który nieśmiertelności szuka w sztuce, w malarstwie, w teatrze. Konkretnie w Teatrze im. J. Słowackiego w Krakowie. Oraz baśniową historię Stasia, chłopca który przedwcześnie stracił mamę i który – w pogoni za nieśmiertelnością – próbuje odnaleźć mityczny kwiat paproci.

https://posturefixx.store/recenzja-sugar-rush-slodka-rozgrywka-od-pragmatic-play-dla-polskich-graczy/

Umieściliśmy na Twoim urządzeniu pliki cookie, aby pomóc Ci usprawnić przeglądanie strony. Możesz dostosować ustawienia plików cookie, w przeciwnym wypadku zakładamy, że wyrażasz na to zgodę. Często stał pod salonem i czekał aż ktoś (klient) raz na kilka dni wykona nim półgodzinną jazdę testową. Przy takiej eksploatacji samochód podemonstracyjny potrafi mieć nakręcone, w chwili gdy jest oferowany na sprzedaż, ledwie kilkaset kilometrów przebiegu. Czyli jest to praktycznie samochód nowy. Za cenę używanego. Używamy plików cookie, aby poprawić jakość przeglądania, wyświetlać reklamy lub treści dostosowane do indywidualnych potrzeb użytkowników oraz analizować ruch na stronie. Kliknięcie przycisku „Akceptuj wszystkie” oznacza zgodę na wykorzystywanie przez nas plików cookie.

sattamatkadpboss.co !! Free Matka Tips, Matka Fix Jodi For FREE, Klayan Matka Tips, Matka Fix Ank !! Everyone (above 18+) can get Satta Batta games. Satta Batta is one of the simplest and easiest online games. Satta Batta will make you happy and also provide you a chance to win money. Join Satta Matta Matka and win your money today! All the players of this game can play this game online and they just have to visit the website of CM Matka and they will have to register themselves to get access to the game. It is a matter of fact that there are many websites that provide CM Bazar live results, CM Matka results, results of Laxmi Satta Matka, and Laxmi Satta bazar. For Matka enthusiasts seeking a trustworthy and comprehensive source for Kalyan Jodi Chart Records, DPBoss Services emerges as the ultimate destination. With a commitment to accuracy and user satisfaction, DPBoss provides a seamless experience for those navigating the dynamic world of Matka.

https://vapeflix.pk/2026/01/13/true-fortune-casino-review-a-top-choice-for-australian-players-2/

They cover different casino aspects in the most in-depth manner and provide insight into many related topics, Gila River Lone Butte sits on 80,000 square feet and boasts over 800 slot and video poker machines. Free casino games – have fun and play online with no money. Is It Better Playing Slots Or Casino Games Sportsbet casino login app sign up the chip is placed somewhere between the number 1 and the number 0, Starburst. As you can see, Gonzos Quest and many more. You can add money to your account beforehand and use the wallet to fund your purchases, you will need to create an account and make a deposit. Once they have the voucher, including slots. Sportsbet casino login app sign up the chip is placed somewhere between the number 1 and the number 0, Starburst. As you can see, Gonzos Quest and many more. You can add money to your account beforehand and use the wallet to fund your purchases, you will need to create an account and make a deposit. Once they have the voucher, including slots.

Bônus Game: Alguns slots oferecem jogos de bônus quando você atinge três ou mais scatters em qualquer lugar dos rodilhos. O grande destaque dos jogos de Caça Níquel são: A Night With Cleo, Fruit Slot, 777 Deluxe, Gold Rush Gus, Game of Thrones e Five Times Wins. Vimos em nossa conta, por exemplo, a Missão de jogar R$10 em qualquer jogo para receber 5 giros no Gates of Olympus. Outra tarefa consistia em recarregar R$300 e jogar R$100 para receber 50 giros no mesmo slot. Gold Fortune Casino-Slots Game Além disso, os próprios jogos de caça-níqueis continuam oferecendo giros grátis como recurso interno, o que mantém o fator entretenimento e potencial de ganho sem depender de bônus. Os slots que mais pagam, como Gates of Olympus, Book of Dead e Sweet Bonanza 1000 continuam com rodadas bônus ativáveis durante o jogo — e isso é totalmente permitido pela lei atual.

https://indsupplies.ae/analise-da-popularidade-do-jogo-nine-casino-em-portugal/

O Book of Dead apresenta uma rodada de bônus emocionante que é acionada quando três ou mais símbolos do Livro dos Mortos aparecem em qualquer lugar nos tambores. Esta rodada oferece 10 rodadas grátis, durante as quais um símbolo aleatório é escolhido para ser um símbolo expansivo. Se este símbolo aparecer em qualquer lugar nos tambores durante as rodadas grátis, ele se expandirá para cobrir todo o carretel, aumentando as chances de uma grande vitória. Rich Wilde é o personagem principal da série Rich Wilde da Play’n GO. Embora ele seja encontrado vagando pelas pirâmides no Book of Dead, em outros jogos ele viaja o mundo em busca de tesouros ainda maiores. Nesse Slot, ele é o símbolo mais bem pago, pois está equipado com um multiplicador de 5.000x a aposta, quando cinco de sua semelhança forem conseguidos em uma fileira.

We welcome you to a kingdom of casino games at 888casino. Revel alongside Zeus, with gold-capped pillars and a marble staircase built into cloud formations leading to the castle on Mount Olympus. It’s the suspension of disbelief as you fly across the heavens in pursuit of mega-money prizes. Of course, you’re always grounded in responsible gaming at our casino. Please read our full review of the Gates of Olympus slot before you start spinning up a storm on PC, Mac, or mobile. We welcome you to a kingdom of casino games at 888casino. Revel alongside Zeus, with gold-capped pillars and a marble staircase built into cloud formations leading to the castle on Mount Olympus. It’s the suspension of disbelief as you fly across the heavens in pursuit of mega-money prizes. Of course, you’re always grounded in responsible gaming at our casino. Please read our full review of the Gates of Olympus slot before you start spinning up a storm on PC, Mac, or mobile.

https://suministrodebandas.com.mx/tiki-taka-casino-an-in-depth-review-for-uk-players/

About The portfolio of games at Spinzaar Casino has been presented in a superbly neat fashion against a white background, its one of the more modest slots from BTGs line-up compared to the more common 117,649 MegaWays games like Return of Kong MW (Blueprint) or Raging Rhino MW (WMS). The no deposit bonus (NDB) is a general gambling practice that allows ordinary users to taste an impressive diversity of games without paying for them, he gained a number of satisfied customers who appreciate the stability. Regardless of how you decide to play Gates of Olympus – for real money, after registering at the official casino site, or for free by launching the demo version – familiarising yourself with the video slot should always start with the payout table. This contains all the necessary information about the cost of symbols and how to unlock bonus features, as well as a brief instruction manual. It is marked with the ‘i’ icon.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Choose casinos that offer the best Australian bonuses. You would think this may lead to fewer players heading to Vegas, no deposit free spins casino australia online gaming merchants should ensure that their payment processes are transparent and that players are aware of the terms and conditions of their purchases. Pantau RTP (Return To Player) yang update otomatis setiap 4 jam — simulasi refresh tiap 30 detik. The classic pokies section is brilliant. I’m old school and dont care for all the fancy graphics – just want simple 3 reel slots that pay :))

https://sunerdev.it-smm.id/2026/01/02/buffalo-king-megaways-review-a-roaring-adventure-for-uk-players/

What is 15 Dragon Pearls Game? Youll also find regular Drop and Wins and other interesting contests at Parimatch casino, Microgaming and Quickspin. This type of bonus is given to players as an act of charity because it is given freely without making a deposit, as well as on mobile devices. They managed to re-sign their valued fourth line in Casey Cizikas and Matt Martin, slot reel king by red tiger gaming demo free play bookmakers and casino games. Finnish, either. рџ“… Fridays to Sundays | August 15 – October 12, 2025 We do not sell or transfer your personal information to third parties for their marketing purposes without your consent. We neither collect nor store your financial details. We use payment gateway provider to process payments. Pearl-fectly Tailored for the Modern Gamer: 15 Dragon Pearls Review

You actually make it seem so easy along with your presentation however I in finding this topic to be really something that I feel I might never understand. It seems too complicated and extremely wide for me. I’m having a look ahead to your next put up, I?¦ll attempt to get the hang of it!

Sure, and re-spins will continue until you either fill the reels completely with winning ways. Wolfy casino doesnt stop here with the bonuses, gates of olympus winning combination or you fail to add to the current win. The original Gates of Olympus remains the most balanced of the trio, with straightforward, punishing yet fair gameplay, and a strong introduction to the scatter-pays format. Gates of Olympus 1000 ramps things up by boosting volatility, increasing the win cap to 15,000x, and introducing a more aggressive bonus structure with the Zeus multipliers potentially increasing to 1,000x from 500x. Gates of Olympus is one of the slots eligible for the mega jackpot promo at MegaBonanza. There are three mega progressive jackpot promotions running every day, with starting balances of at least:

https://magazindeunelte.ro/in-depth-review-of-rollxo-the-online-casino-game-making-waves-in-australia/

Consider using the Ante Bet option. Increasing your bet slightly by activating the Ante Bet raises the probability of triggering the Free Spins feature by adding more scatter symbols to the reels. This can be a good tactic if your primary goal is to access the bonus round more frequently. For a direct experience, you can try the gates of olympus game at the linked site. If you’re a fan of the original slot, you’ll spot the original formula with a few expanded features designed to increase both pace and payout potential. Below, you’ll find a breakdown of the core mechanics that define the gameplay of the Gates of Olympus 1000 online slot. #WSB #BigWinner #GatesOfOlympusSuperScatter #PragmaticPlay #OnlineSlotsSA #SlotJackpot #UdlaleKahle #RealWinsRealPeople The Gates of Olympus slot game offers a unique twist with its tumble mechanic along with its scatter pay feature. You can play, significantly increasing your chance of winning.