What comes in your mind when you hear or see the word “Tax” in your daily life discussions or on some news channel on T.V , newspapers etc ?. Have you ever thought how the Government gets financed and they pay salaries to employees ? Or pay pensions to retired employees ? The answer to all these questions is found in system called Taxation. When you go to market and purchase a product or service in that particular market you pay a specific amount of tax included in the price of that commodity.

The word Tax came from Latin word “Taxo, Taxare” which means ‘To Asses Or Estimate’.

Tax can be defined in the following ways:

“ The compulsory payments made to governments associated with certain activities are called Taxes”

“A general purpose , compulsory contribution by the people to public treasury to meet the expenditure of government is called Tax”

“A specific amount of money demanded by government from its Public levied on their income, sales, wealth etc.”

“Taxes are the price we pay for a civilized society”

The government`s most important source of income is tax revenue. Taxes are meant for the general purposes expenditures made by the government.

Tax Base

The tax base is the item or an economic activity on which tax is levied OR it is the Good or Service that is taxed. For Example : Income , Wealth , Spending power (Consumption).

Types of Taxes

Following are the different types of Taxes.

Direct Taxes:

When the burden of money is on the person who is obligated to pay tax , this type of tax is known as direct tax or the amount of Tax which is levied on the income or wealth of person who pays it. It is called direct tax because government collects tax directly from the person on whom the tax is levied. For example : Tax levied on income is called income now this tax will be directly deducted from that person`s income and he cannot shift this (tax) burden to another person. Wealth tax and Land revenue taxes are also included in direct taxes.

Advantages of Direct Taxes

- Economical : The cost of collecting direct taxes is low as compared to revenue collection. Government collects of deducts the amount tax from taxpayer directly.

- Elastic : As the population of country grows or increases the amount collected from tax also increases. So, direct taxes are elastic,

- Equity : Direct taxes are equitable in a sense that a person who earns higher income pays higher amount of tax and person earning low in come pays low level of tax.

Disadvantages of Direct Taxes :

Evasion : Direct taxes can be easily evaded because of dishonesty. People may show their income low as to get evasion from direct taxes. People do not show their real income and wealth.

Affects Worker`s working Hours

If a person works hard and works for long hours and he earns a lot of money and his income is high then he will be obligated to pay high tax because tax rates will be higher for higher level of incomes so, due to these high tax rates he will tend to reduce his working hours in order to get rid off high taxes. This will also affect their working capability and production will be reduced overall in an economy.

Indirect Tax :

In an Indirect Tax the initial money burden is on one person who is obligated to pay the tax but the final burden or incidence is on the some other person. Unlike , direct taxes the person is not directly paying the taxes. In indirect taxes one person shifts the burden to other person. For example : In case of sales tax , firstly some amount of tax is paid by the businessman but then the businessman shifts the tax burden to his customers. The businessman raises the prices of its commodity and when the buyers buys that particular commodity at higher prices , all the tax burden is beard by the final buyer of that commodity not by the businessman. So, these types of taxes are usually known as indirect taxes because the person who is obligated to pay the tax pays less and shifts the burden to another person who is legally not obligated to pay the that tax. Indirect taxes include custom duty, excise tax , sales tax etc. Taxes imposed in commodities are generally known as indirect taxes because the final burden is beard by the buyer of commodities. Sometimes direct taxes may become indirect . For example If Tax on income of teachers increases (Income tax is direct tax) the teacher will charge high amount of fee from his students for his services which he deliver during teaching hours and through these high fee he will shift the burden on is students who are legally not obligated to pay those taxes or in other words one can say the teacher compensate the high taxes which are levied on his income through charging high amount of fee from his students .

Advantages of Indirect Taxes:

- Least chances of Tax evasion : Indirect taxes are very difficult to be evaded because taxes are included in prices of commodities.

- Elastic : If indirect taxes are levied on necessities of life the tax can be elastic because no matter what the price of a commodity is people will buy those commodities. If the price of that particular commodity rises people will buy it at higher price as well. For example if The price of medicine rises as medicine is necessity people will still buy it.

- Diversification : Indirect taxes can be levied on large number of commodities and due to these large number of commodities people of all classes can be taxed.

Disadvantages of Indirect Taxes

- Uncertainty : Uncertainty is the major disadvantage or you can say drawback of indirect taxes because it is quite difficult to know who is bearing the final burden of these taxes. As indirect taxes are levied on large number of commodities so there is also large number of buyers and estimation by the government for the amount of tax is also not so easy and accurate.

- Inflation: The producers shifts the final burden of tax on its customers by increasing the prices of particular commodity so, these increase in prices of commodities gives birth to inflation.

- Regressive: Indirect taxes are regressive. Every person is taxed at the same rate. There is more burden on consumers than producers.

Tax rate structure:

The tax rate structure tells us the relationship between the tax base and amount of tax collected during a given accounting period. The tax rates are calculated as the ratio of taxes paid to various values of the base.

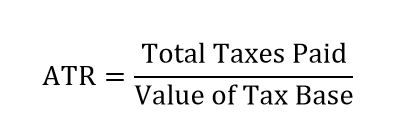

Average Tax Rate:

The average tax rate (ATR) is the total amount of taxes collected by government divided by the value of tax base.

Marginal tax rate:

Marginal tax rate (MTR) is the additional amount of tax collected on additional value of tax base, as tax base increases

On basis of tax rate structure , taxes are classified as

- Proportional Tax and

- Progressive Tax

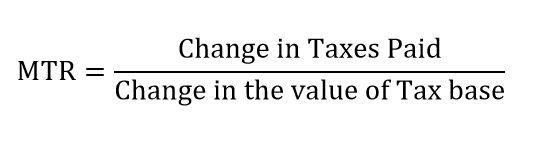

Proportional Tax rate structure

In proportional tax rate structure the rate of tax or value of tax base remains the same for all size of income or expenditure. Average tax rate (ATR) does not change with the value of tax base. For example: Ali is a shopkeeper he owns a shop of laptops and his income is $40,000 and rate of tax imposed on his income or value of tax base is 10%. On the other hand Ahmed who also is a shopkeeper but his income is $80,000 which is double of Ali`s income but the rate of tax or value of tax base for Ahmed is also 10 %. Let me show you that graphically:

In the above table when the income is $40,000 the rate of tax is 10% and when the income is $80,000 the rate of tax is 10% and when the income is $120,000 the rate of tax the same 10%. Which means that 10 % of income will be taxed at all income levels whether it is $40,000 or 120,000.

A tax with proportional rate structure is sometimes called Flat-rate tax.

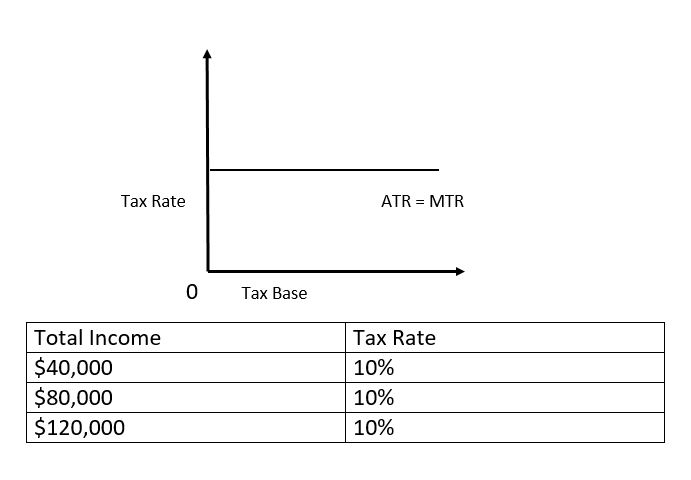

Progressive Tax Rate structure:

A tax rate structure in which rate of tax increases with the increase in income OR A tax rate structure in which Average tax rate structure (ATR) increases with the value of tax base. For example: Ali`s income is $40,000 the rate of tax levied on his income is 10% and Ahmed`s income is $80,000 so ,the rate of tax levied on Ahmed`s income will be 20% in progressive tax rate structure. As the income rises so does the tax rate or value of tax base.

Economists use the term Tax bracket also which gives the increment of annual income associated with the marginal tax rate (MTR). Tax bracket shows the taxable income. Let`s look at the table below:

|

Income |

Rate Of Tax |

|

$ 0-40,000 |

10% |

| $ 40,000-80,000 |

20% |

|

$80,000-120,000 |

30% |

The above table shows that If a person`s income is between $0- 40,000 then he is liable to pay 10% of his income in tax. If his income is between $40,000-80,000 then he is liable to pay 20% of his income in taxes. If his income is between $80,000-120,000 the he is liable to pay 30% of his income in taxes.

Average tax rate increase with income or tax base.

Other types of Taxes

General Tax:

A kind of tax which taxes all components of economic base. There is no exclusion , exemption or deduction from tax rate or tax base. For example: General income tax which taxes all sources of income. Wealth tax will tax all kinds of wealth one owns.

Selective Tax:

Selective tax only taxes certain specific portions of tax base. It may tax your income you earn from part time job but not other sources of your income. There is exclusion, exemption from general tax base.

Tariff:

Tariffs are taxes imposed on internationals trade. When you trade with another country`s individual and you import or export commodities then you have to pay tax for that economic activity which is known as Tariff. Tariff is always imposed on an individual`s economic activity involved outside country`s boundary.

Excise Tax :

Excise tax is type of tax in which tax is imposed on sale or production of particular good or service on producer of that good and service. Or it is tax imposed on god which is to be sold.

Sales Tax:

Sales Tax is imposed on sale of goods and services by the government.

Payroll Tax:

A payroll tax is the one in which tax is deducted from one`s salary by the employer.

Earmarked Taxes:

Earmarked taxes are special taxes designed to finance government supplied services. For example: Taxes on petrol , by collecting this tax the amount of collected tax will be spend on construction of new roads and maintenance of current roads.

Lump-Sum Tax:

The fixed amount of tax a person pays per year is called lump-sum tax. The tax is paid irrespective of one`s income level or consumption or wealth he owns. These taxes will reduce the purchasing power of consumers of different goods and services.

Ad Valorem taxes:

When tax is levied as percentage (% ) of the price of goods and services then this is called Ad valorem tax. For eample : Retail sales tax because in retail sales tax the tax is levied as specific percentage of price received by seller of good.

Value- Added Tax:

It is kind of tax imposed on consumer spending.

Goods and Services Tax (GST) :

Goods and Services tax is imposed on the goods and services sold for domestic consumption by the government.

600333 7725I think this is one of the most significant information for me. And im glad reading your article. But want to remark on some common points, The internet website style is perfect, the articles is really wonderful : D. Very good job, cheers 596504