In previous articles you have learned about macroeconomic indicator like GDP which is highly important for understanding business cycles and economic performances and GNI which can offer a perspective on the living standards of a country’s residents. We are now going to have a look at the Consumer Price Index (CPI), a macroeconomic indicator with a significant impact on interest rates, in the long run.

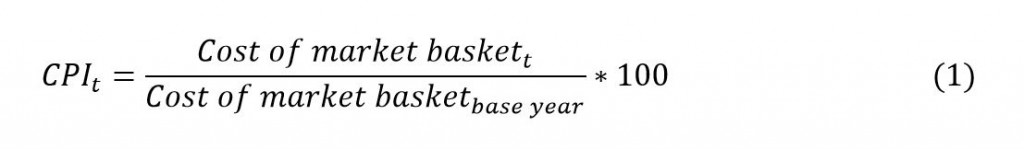

Consumer Price Index (CPI) is usually computed by dividing the market price of a certain basket of goods in a specific year, corresponding to the price of the same basket of goods in a year of reference or base year. The result is then multiplied with 100 to get the CPI:

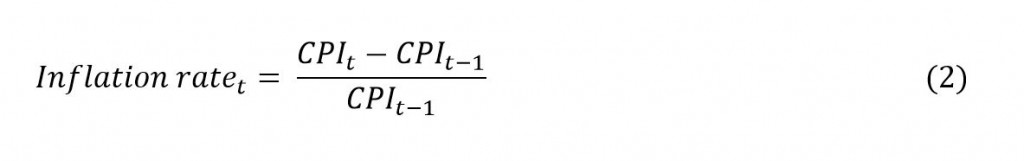

By looking at the change of consumer goods prices, the CPI is a popular measure for inflation. The formula for the inflation rate, based on the CPI is the following:

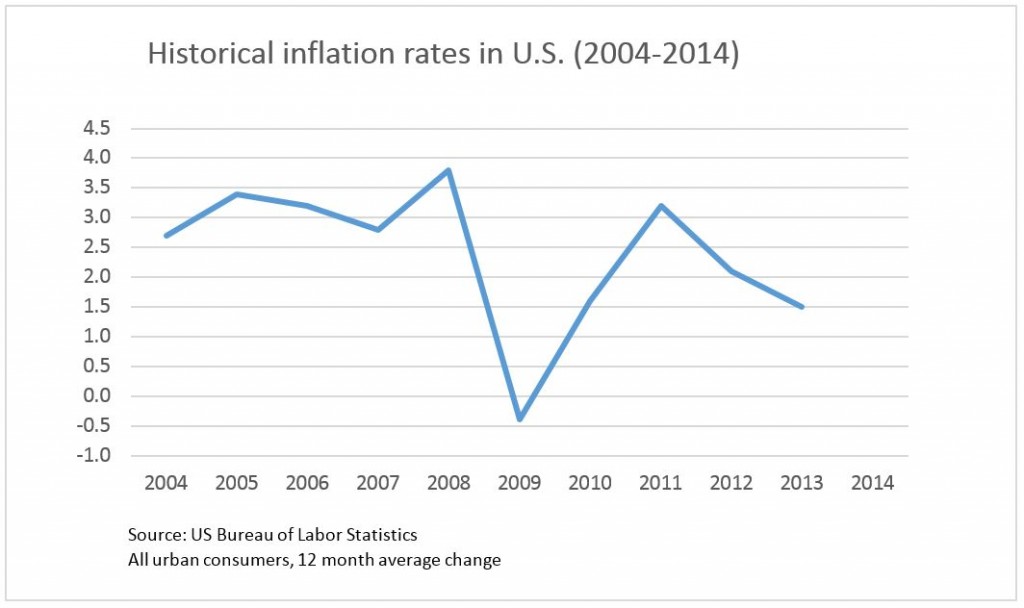

Hence, we can deduct from formula (2) above that when the Consumer Price Index increases, inflation rate increases as well. Whereas a rise of the inflation rate is not always a negative sign for the economy, on the short-term, especially during recovery times, inflation rate does have a damaging impact in the long run, if its level remains high or increases. A booming economy deals with rising inflation rates, which eventually affects the terms of trade on the global market.

Since a high level of inflation maintained for a long time has a negative impact over the purchasing power, it also influences the Forex markets, driving investments down. Therefore, during inflationary periods, Central Banks and the Federal Reserve feels the need to increase the interest rates, in order to compensate for the high inflation rate. With higher interest rates, the currency appreciates and investors are attracted to buy stocks.

The author is studying for an MSc Economics and Finance at the University of Leeds Business School, United Kingdom.

Hi, Neat post. There’s a problem with your web site in internet explorer, would test this… IE still is the market leader and a big portion of people will miss your great writing due to this problem.

The winter lelands sports memorabilia card show

in Orlando was stacked this year