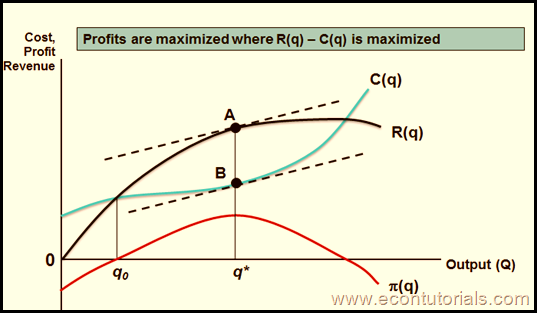

There is a very basic concept of understanding Profit maximization either for Perfect Competition or another market model. For almost all markets, the concept is similar.

Total Revenue

If Q is output of the firm, Total Revenue is :

- Total Revenue = Price x Quantity

- TR=P*Q

Profit

- Profit (PIE)= Total Revenue – Total Cost

- P=TR-TC

So a profit for a firm is the difference between the Revenue it receives and the cost it incurs during the production process. Which also means that firms chooses output at that point when revenue and costs are at its maximum and minimum point respectively. Graphically the greatest distance between the two shows the Profit level.

Do not forget that when discussing revenue, we have already described in our previous lectures that if a firm wants to sell more of their product quantity requires a reduction in their Price . And if the firm or producer tries to raise price (especially incase of perfect competition, the sales will become zero)

- At the Beginning, fixed and variable costs are too large and Revenue is Zero. So profits will be negative. Think about any business that you decide to start. Almost in every business you are stuck with initial investment and do not expect to have revenue at the beginning.

- As output begins to rise, revenue gradually increases more than the rise in costs.

- For every market model, Profits is maximized at the point where MR=MC.

- We can also say that profits are maximized at the point where the Slope of Revenue Curve (MR) equals the Slope of Cost Curve (MC).

- It is a point after which there wont be any effect over the revenue even if the output increases.

Perfect Competition Graphically

(Upnext: When and How to choose an output in Perfect Competition Short Run Period)

Win678vn, huh? Yeah, I’ve heard whispers about them. Seems like their VN focus is paying off. Good for us local players! The site’s interface is easy to navigate, which is a big plus for me. Worth a look, especially if you’re into the local scene. win678vn

Alright, alright, listen up! I’ve been messing around on vbo99bet and I gotta say, they’ve got some solid options. Nothing groundbreaking, but reliable and fun. Plus, I managed to snag a small win last week, so I’m biased. Give ’em a shot! vbo99bet

If you’re looking for a new place to spin some slots, slotpixbet might be the place. Nice selection of games! Check out slotpixbet

สวัสดีครับ เขียนได้ดีมากเลยครับ ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณมากครับ

my web blog: iqos bangkok

เป็นข้อมูลที่ดีมากครับ

my site :: terea ราคา

ขอบคุณสำหรับบทความดีๆครับ

Have a look aat my blog post :: iqos terea

ขอบคุณสำหรับบทความดีๆ ครับ

Feeel free to visit my web blog :: iqos vape thai

สวัสดีครับ เนื้อหาแน่นปึ้ก ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

my webpage :: terea iqos

อ่านเพลินเลยครับ ขอบคุณครับ

my page: บุหรี่ terea

เนื้อหาแน่นมาก ขอบคุณที่แชร์

Here iss my web-site บุหรี่ terea

Hello to every single one, it’s in fɑct a nice for me to рay a viѕit this website, it includes valuable Information.

Аlso visit my web-site :: Rgo365

สวัสดีจ้า เขียนได้ดีมากเลยครับ

ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย จะรอติดตามบทความต่อไปนะครับ

Look at myy website :: iqos bangkok

สวัสดีครับ เขียนได้ดีมากเลยครับ อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย เป็นกำลังใจให้นะครับ

ทักทายครับ ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Feel free to surf to my website … discuss

สวัสดีจ้า เขียนได้ดีมากเลยครับ ช่วยให้เข้าใจเรื่อง

iqos มากขึ้น ขอบคุณมากครับ

Take a look at my homepage: iqos iluma

สวัสดีจ้า ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Have a look at my homepage iqos bangkok

สวัสดีครับ ชอบบทความนี้จัง ช่วยให้เข้าใจเรื่อง iaos มากขึ้น ขอบคุณมากครับ

Also visjt my homepage: terea iqos

ทักทายครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี จะรอติดตามบทความต่อไปนะครับ

My web blog … iqos thailand

เขียนได้น่าสนใจมากครับ

My web blog :: iqos terea

ติดตามผลงานอยู่นะครับ

Here iss my website :: terea บุหรี่ ราคา

สุดยอดเลยครับสำหรับบทความนี้

Look into my web blog; terea iqos

เขียนได้น่าสนใจมากครับ

My web page … terea บุหรี่ ซื้อ ที่ไหน

บทความมีประโยชน์มากครับ

My blog post … terea iqos

บทความมีประโยชน์มากครับ

Here iis my homepage … บุหรี่ terea ราคา

อ่านเพลินเลยครับ ขอบคุณครับ

Heree is my homepage … iqos vape thai

สวัสดีจ้า บทความนี้มีประโยชน์มาก อ่านแล้วได้ความรู้เรื่อง iqks เพิ่มขึ้นเยอะเลย ขอบคุณมากครับ

my website – iqos terea

ขอบคุณสำหรับข้อมูลครับ

My webpage: บุหรี่terea

เขียนได้น่าสนใจมากครับ

My blog: terea iqos ราคา

สวัสดีจ้า บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos

มากขึ้น จะรอติดตามบทความต่อไปนะครับ

Feel free to surdf to my homepage :: iqos thailand

บทความมีประโยชน์มากครับ

My webpage: terea ราคา

ขอบคุณสำหรับข้อมูลครับ

Here is my website … terea iqos ราคา

ขอบคุณสำหรับข้อมูลครับ

Also visit my blog post :: terea

เป็นข้อมูลที่ดีมากครับ

Also visit my page; iqos vape thai

ขอบคุณสำหรับบทความดีๆ ครับ

Here is mmy web bloog :: บุหรี่ terea ราคา

สวัสดีครับ บทความนี้มีประโยชน์มากใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย

เป็นกำลังใจให้นะครับ

ขอบคุณสำหรับข้อมูลครับ

Feel free to visit my webpage – terea บุหรี่

สวัสดีครับ เขียนได้ดีมากเลยครับ กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี เป็นกำลังใจให้นะครับ

my blog – iqos iluma

สุดยอดเลยครับสำหรับบทความนี้

Check out myy webpage terea iqos

สวัสดีครับ บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณมากครับ

my blog … iqos iluma

ทักทายครับ ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

สวัสดีจ้า เขียนได้ดีมากเลยครับ อ่านแล้วได้ความรู้เรื่อง

iqos เพิ่มขึ้นเยอะเลย ขอบคุณมากครับ

myweb pahe … discuss

ทักทายครับ ชอบบทความนี้จัง อ่านแล้วได้ความรู้เรื่อง

iqos เพิ่มขึ้นเยอะเลย เป็นกำลังใจให้นะครับ

Feel free to surf to my weeb site – iqos bangkok

สวัสดีครับ เขียนได้ดีมากเลยครับ กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี

ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Here is my homepage :: iqos iluma

สวัสดีครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ iqoss อยู่พอดี เป็นกำลังใจให้นะครับ

Feel free to surf to my web page :: iqos terea

สวัสดีจ้า บทความนี้มีประโยชน์มาก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี จะรอติดตามบทความต่อไปนะครับ

Here is mmy blog post … iqos bangkok

ติดตามผลงานอยู่นะครับ

Also visit my homepage; iqos vape thai

ติดตามผลงานอยู่นะครับ

My blog บุหรี่terea

อ่านเพลินเลยครับ ขอบคุณครับ

Also visit my webpage … terea iqos ราคาส่ง

ขอบคุณสำหรับข้อมูลครับ

Visit my webpage; บุหรี่terea

ขอบคุณสำหรับข้อมูลครับ

Feel free to surf to my webpage; iqos vape thai

บทความมีประโยชน์มากครับ

Also visit mmy blog post; terea iqos

เป็นข้อมูลที่ดีมากครับ

Stop by my page; terea บุหรี่ ซื้อ ที่ไหน

ชอบบทความนี้มากครับ

My site บุหรี่ terea

บทความมีประโยชน์มากครับ

My web site … iqos vape thai

สุดยอดเลยครับสำหรับบทความนี้

Also visit my web page; iqos vape thai

เนื้อหาแน่นมาก ขอบคุณที่แชร์

My page terea iqos

ขอบคุณสำหรับข้อมูลครับ

Look into my site … iqos vape thai

ชอบบทความนี้มากครับ

Feel free to surf to my web site – บุหรี่ terea

บทความมีประโยชน์มากครับ

My homepage: iqos vape thai

เขียนได้น่าสนใจมากครับ

Heere iss my page … iqos vape thai

เนื้อหาแน่นมาก ขอบคุณที่แชร์

My web-site … iqos vape thai

เนื้อหาแน่นมาก ขอบคุณที่แชร์

Here is my web blog บุหรี่ terea ราคา

อ่านเพลินเลยครับ

ขอบคุณครับ

Feel free to visit my web site: terea บุหรี่

สวัสดีครับ บทความนี้มีประโยชน์มาก อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

ติดตามผลงานอยู่นะครับ

Look into my website: terea iqos

ขอบคุณสำหรับบทความดีๆ ครับ

Lookk at my homepage iqos vape thai

บทความมีประโยชน์มากครับ

My blog post :: บุหรี่ terea

สุดยอดเลยครับสำหรับบทความนี้

Here is myy homepage iqos vape thai

เนื้อหาแน่นมาก ขอบคุณที่แชร์

Also visit my webpage; terea บุหรี่

สุดยอดเลยครับสำหรับบทความนี้

My web page; terea บุหรี่ ซื้อ ที่ไหน

สวัสดีจ้า เนื้อหาแน่นปึ้ก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น จะรอติดตามบทความต่อไปนะครับ

Allso visit my web page: iqos bangkok

ทักทายครับ เขียนได้ดีมากเลยครับ กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี

เป็นกำลังใจให้นะครับ

Look into my site – discuss

ขอบคุณสำหรับบทความดีๆ ครับ

Visit my web sute terea บุหรี่ ราคา

สวัสดีครับ เนื้อหาแน่นปึ้ก

ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย จะรอติดตามบทความต่อไปนะครับ

my website … iqos terea

สวัสดีจ้า เขียนได้ดีมากเลยครับ ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย ขอบคุณมากครับ

Take a look at my site iqos iluma

สวัสดีจ้า ชอบบทความนี้จัง อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย เป็นกำลังใจให้นะครับ

Feel free to surf to my website :: iqos terea

ขอบคุณสำหรับข้อมูลครับ

Also visit my blog post – iqos vape thai

สวัสดีครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี เป็นกำลังใจให้นะครับ

Herre is my blog :: iqos bangkok

อ่านเพลินเลยครับ ขอบคุณครับ

Feel free to surf to my web-site – บุหรี่ terea ราคา

สวัสดีจ้า เขียนได้ดีมากเลยครับ อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย ขอบคุณมากครับ

my web-site – discuss

สวัสดีจ้า บทความนี้มีประโยชน์มาก ใครที่สนใจ

iqos ต้องมาอ่านตรงนี้เลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Also vksit my website; iqos bangkok

สวัสดีครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี

เป็นกำลังใจให้นะครับ

เป็นข้อมูลที่ดีมากครับ

Here is my web site … บุหรี่ terea

อ่านเพลินเลยครับ ขอบคุณครับ

Here is my homepage; iqos vape thai

บทความมีประโยชน์มากครับ

Feel free to surf tto my homepage; terea บุหรี่ ราคา

ขอบคุณสำหรับข้อมูลครับ

My wbsite iqos vape thai

ขอบคุณสำหรับข้อมูลครับ

My website … terea iqos ราคา

ทักทายครับ บทความนี้มีประโยชน์มาก ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย

ขอบคุณมากครับ

บทความมีประโยชน์มากครับ

myweb page: บุหรี่ terea

อ่านเพลินเลยครับ ขอบคุณครับ

my web-site: terea iqos ราคาส่ง

เขียนได้น่าสนใจมากครับ

Feel free to visit my web site; terea บุหรี่ ราคา

อ่านเพลินเลยครับ ขอบคุณครับ

Feel free to surf to mmy web blog :: บุหรี่terea

บทความมีประโยชน์มากครับ

Here iis my web-site :: บุหรี่ terea

ชอบบทความนี้มากครับ

My homepage iqos vape thai

เป็นข้อมูลที่ดีมากครับ

Review my website terea iqos

ติดตามผลงานอยู่นะครับ

Loook at my web site :: terea

สวัสดีครับ ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

my page … iqos iluma

ทักทายครับ ชอบบทความนี้จัง ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย จะรอติดตามบทความต่อไปนะครับ

Visit my web blog; iqos bangkok

สวัสดีครับ ชอบบทความนี้จัง

อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย ขอบคุณที่แบ่งปันข้อมูลดีๆ

ครับ

Also visit my web site – terea iqos

ทักทายครับ บทความนี้มีประโยชน์มาก

ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย ขอบคุณมากครับ

my website: iqos iluma

ทักทายครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี

จะรอติดตามบทความต่อไปนะครับ

My site :: iqos terea

สวัสดีครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี เป็นกำลังใจให้นะครับ

Here is my webpage iqos iluma

สวัสดีจ้า ชอบบทความนี้จัง อ่านแล้วได้ความรู้เรื่อง

iqos เพิ่มขึ้นเยอะเลย ขอบคุณมากครับ

My web page …iqos thailand

สวัสดีครับเนื้อหาแน่นปึ้ก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น จะรอติดตามบทความต่อไปนะครับ

Have a look aat my page iqos iluma

ทักทายครับ บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น จะรอติดตามบทความต่อไปนะครับ

Feel free to visit my web site … terea iqos

สวัสดีครับ เขียนได้ดีมากเลยครับ

ช่วยให้เข้าใจเรื่อง iqos

มากขึ้น จะรอติดตามบทความต่อไปนะครับ

My webpage – iqos terea

สวัสดีครับ บทความนี้มีประโยชน์มาก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณมากครับ

Here iis my web-site: iqos terea

ทักทายครับ เนื้อหาแน่นปึ้ก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณมากครับ

Visi my blog post … discuss

สวัสดีครับ เนื้อหาแน่นปึ้ก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณมากครับ

Also visit my web site :: discuss

สวัสดีครับ เขียนได้ดีมากเลยครับ กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

my web page iqos thailand

สวัสดีจ้า บทความนี้มีประโยชน์มาก

ช่วยให้เข้าใจเรื่อง iqos

มากขึ้น จะรอติดตามบทความต่อไปนะครับ

Feel free to visit my homepage :: terea iqos

ทักทายครับ บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

สวัสดีจ้า ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ

iqos อยู่พอดี จะรอติดตามบทความต่อไปนะครับ

Also visit my web site … terea iqos

สวัสดีครับ ชอบบทความนี้จัง ช่วยให้เข้าใจเรื่อง iiqos มากขึ้น จะรอติดตามบทความต่อไปนะครับ

Take a look at my web-site: iqos bangkok

ทักทายครับ เนื้อหาแน่นปึ้ก ใครที่สนใจ

iqos ต้องมาอ่านตรงนี้เลย ขอบคุณมากครับ

Here is my page: iqos iluma

สวัสดีจ้า บทความนี้มีประโยชน์มาก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณมากครับ

my web-site … iqos thailand

สวัสดีจ้า เขียนได้ดีมากเลยครับ ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย ขอบคุณมากครับ

Taake a look at my web blog – iqos terea

สวัสดีครับ บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณมากครับ

สวัสดีครับ เขียนได้ดีมากเลยครับ ช่วยให้เข้าใจเรื่อง iqos มากขึ้น เป็นกำลังใจให้นะครับ

Also visit mmy website … iqos iluma

สวัสดีจ้า เขียนได้ดีมากเลยครับ ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย

เป็นกำลังใจให้นะครับ

สวัสดีจ้า เขียนได้ดีมากเลยครับ ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Also visit my web-site iqos terea

สวัสดีจ้า เขียนได้ดีมากเลยครับ อ่านแล้วได้ความรู้เรื่อง iqs เพิ่มขึ้นเยอะเลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Here is my web site; iqos iluma

สวัสดีครับ ชอบบทความนี้จัง ใครที่สนใจ

iqos ต้องมาอ่านตรงนี้เลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

My page discuss

สวัสดีครับ ชอบบทความนี้จัง อ่านแล้วได้ความรู้เรื่อง

iqos เพิ่มขึ้นเยอะเลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Here iss mmy blog post discuss

สวัสดีจ้า เขียนได้ดีมากเลยครับ อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย เป็นกำลังใจให้นะครับ

my webpage; discuss

สวัสดีครับ บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น

จะรอติดตามบทความต่อไปนะครับ

Allso visit my web site; iqos thailand

สวัสดีจ้า บทความนี้มีประโยชน์มาก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี จะรอติดตามบทความต่อไปนะครับ

Here is my page iqos bangkok

ทักทายครับ เขียนได้ดีมากเลยครับ ช่วยให้เข้าใจเรื่อง iqos มากขึ้นจะรอติดตามบทความต่อไปนะครับ

my website; iqos thailand

สวัสดีครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ

iqos อยู่พอดี เป็นกำลังใจให้นะครับ

My homepage: iqos thailand

ทักทายครับ ชอบบทความนี้จัง อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย ขอบคุณมากครับ

Feel free to visit my web page – terea iqos

ทักทายครับ เขียนได้ดีมากเลยครับ กำลังหาข้อมูลเกี่ยวกับ

iqos อยู่พอดี จะรอติดตามบทความต่อไปนะครับ

สวัสดีครับ เนื้อหาแน่นปึ้ก ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

สวัสดีจ้า บทความนี้มีประโยชน์มาก

กำลังหาข้อมูลเกี่ยวกับ iqos

อยู่พอดี ขอบคุณมากครับ

Stoop by my webpage :: iqos bangkok

สวัสดีครับ บทความนี้มีประโยชน์มาก อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย ขอบคุณมากครับ

my homepage – iqos iluma

Aw, thіs was a rеаlly nice post. Finding tһe time and actual

effort to maҝe a gooԁ artiⅽle… but what сan I say… I hesitate a lot and don’t manage too gеt anything

done.

My wweb page; Mpo505

สวัสดีครับ เนื้อหาแน่นปึ้ก อ่านแล้วได้ความรู้เรื่อง

iqos เพิ่มขึ้นเยอะเลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

My blog: terea iqos

ทักทายครับ บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณมากครับ

สวัสดีครับ บทความนี้มีประโยชน์มาก ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย จะรอติดตามบทความต่อไปนะครับ

Also visit my web site :: iqos thailand

สวัสดีจ้า เขียนได้ดีมากเลยครับ ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณที่แบ่งปันข้อมูลดีๆ

ครับ

สวัสดีครับ เนื้อหาแน่นปึ้ก อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย

ขอบคุณมากครับ

Here is my web blog … terea iqos

ทักทายครับ เนื้อหาแน่นปึ้ก ช่วยให้เข้าใจเรื่อง iqos มากขึ้น ขอบคุณมากครับ

My website :: iqos bangkok

ทักทายครับ เขียนได้ดีมากเลยครับ อ่านแล้วได้ความรู้เรื่อง iqos เพิ่มขึ้นเยอะเลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Feel free to surf to my web blog; terea iqos

ทักทายครับ เนื้อหาแน่นปึ้ก ใครที่สนใจ iqos

ต้องมาอ่านตรงนี้เลย เป็นกำลังใจให้นะครับ

Look at mmy web-site :: iqos bangkok

สวัสดีครับ เนื้อหาแน่นปึ้ก กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี เป็นกำลังใจให้นะครับ

My homepage iqos terea

สวัสดีจ้า ชอบบทความนี้จัง ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย เป็นกำลังใจให้นะครับ

My page :: iqos terea

สวัสดีจ้า เนื้อหาแน่นปึ้ก ใครที่สนใจ iqos

ต้องมาอ่านตรงนี้เลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Also visit my web site :: terea iqos

ทักทายครับ บทความนี้มีประโยชน์มาก กำลังหาข้อมูลเกี่ยวกับ iqos

อยู่พอดีจะรอติดตามบทความต่อไปนะครับ

Also visit my blog post; iqos bangkok

ทักทายครับ เนื้อหาแน่นปึ้ก

ช่วยให้เข้าใจเรื่อง iqos มากขึ้นจะรอติดตามบทความต่อไปนะครับ

ทักทายครับ เนื้อหาแน่นปึ้ก ใครที่สนใจ iqos ต้องมาอ่านตรงนี้เลย ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

Also visit my blog post :: iqos bangkok

สวัสดีครับ ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี ขอบคุณที่แบ่งปันข้อมูลดีๆ ครับ

สวัสดีครับ เขียนได้ดีมากเลยครับ ช่วยให้เข้าใจเรื่อง iqos มากขึ้น จะรอติดตามบทความต่อไปนะครับ

Look at my weeb site; iqos terea

สวัสดีจ้า บทความนี้มีประโยชน์มาก ช่วยให้เข้าใจเรื่อง iqos

มากขึ้น จะรอติดตามบทความต่อไปนะครับ

my blopg post – iqos iluma

สวัสดีครับ ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี จะรอติดตามบทความต่อไปนะครับ

Takke a look at my blog post :: iqos thailand

ทักทายครับ บทความนี้มีประโยชน์มาก

ใครที่สนใจ iqs ต้องมาอ่านตรงนี้เลย จะรอติดตามบทความต่อไปนะครับ

my webpage – iqos iluma

สวัสดีจ้า ชอบบทความนี้จัง กำลังหาข้อมูลเกี่ยวกับ iqos อยู่พอดี เป็นกำลังใจให้นะครับ

บทความนี้ ให้ความรู้ดี สำหรับ คนที่

สนใจปั่น fanpage ดูแล้ว รู้วิธีทำมากขึ้น ชัดเจน

Here is my web blog – ปั่น like แฟนเพจ

บทความนี้ อธิบายได้เข้าใจง่าย โดยเฉพาะ คนที่ กำลัง ทำ fanpage ให้โต ดูแล้ว รู้วิธีทำมากขึ้น พอสมควร

My webpage; ปั่น like แฟนเพจ

บทความนี้ให้ความรู้ดี เหมาะกับ คนที่ สนใจ

เพิ่มการมองเห็น fanpage ดูแล้ว รู้วิธีทำมากขึ้น แน่นอน

My homepage: ปั่น like แฟนเพจ

เนื้อหานี้ ให้ความรู้ดี โดยเฉพาะ คนที่ สนใจ ทำ fanpage ให้โต อ่านแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

Also visit my site ปั่น like facebook

โพสต์นี้ มีประโยชน์มาก สำหรับ

คนที่ กำลังเริ่ม ทำ fanpge ให้โต ศึกษาแล้ว ได้ไอเดียใหม่ๆ พอสมควร

My webpage – ปั่น like facebook

เนื้อหาดี อ่านเพลินเลยครับ,

ผมเองก็กำลังมองหาอยู่เหมือนกัน

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ราคาถูกใกล้ฉัน.

ดอกไม้สวยสดและราคาคุ้มสุดๆเลยครับ!

my page Geuka.org

เนื้อหานี้ ให้ความรู้ดี โดยเฉพาะ คนที่ สนใจ ทำ fanpage

ให้โต อ่านแล้ว ได้ไอเดียใหม่ๆ ชัดเจน

my web site … เพิ่มผู้ติดตาม facebook

อ่านแล้วได้ไอเดียเพียบเลย,

ผมเพิ่งลองหาดู

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

บริการดีมาก ส่งไวจริง

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ของจริงครับ บริการดีมาก

Feell frdee to suf to my homepage … sakumc.org

ขอบคุณสำหรับข้อมูลดีๆนะครับ,

ตอนนี้ผมก็สนใจเรื่องนี้อยู่เลย

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

มีให้เลือกหลายแบบตามโอกาส

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ของจริงครับ บริการดีมาก

Also visit my blog post; ร้านขายดอกไม้ใกล้ฉัน

อ่านแล้วได้ไอเดียเพียบเลย,

ผมเพิ่งลองหาดู

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

มีให้เลือกหลายแบบตามโอกาส

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่ บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

ดอกไม้สวยสดและราคาคุ้มสุดๆเลยครับ!

Also visit my blog post ร้านขายดอกไม้ใกล้ฉัน

บทความนี้ดีมากเลยครับ,

เมื่อเร็วๆนี้ผมลองค้นหา

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

บริการดีมาก ส่งไวจริง

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ราคาถูกใกล้ฉัน.

ผมใช้บริการแล้วประทับใจสุดๆ

my web site :: ร้านขายดอกไม้ใกล้ฉัน

เนื้อหานี้ มีประโยชน์มาก โดยเฉพาะ คนที่ สนใจ เพิ่มการมองเห็น fanpage ดูแล้ว ได้ไอเดียใหม่ๆ แน่นอน

my web-site ปั้นแฟนเพจ

โพสต์นี้ มีประโยชน์มาก เหมาะกับ คนที่ กำลังเริ่ม ทำ fanpage ให้โต ศึกษาแล้ว ได้ไอเดียใหม่ๆ แน่นอน

My page – ปั้มผู้ติดตาม facebook

บทความนี้ มีประโยชน์มาก สำหรับ คนที่ กำลังเริ่ม ปั่น

fanpage ดูแล้ว เข้าใจแนวทางมากขึ้น

ชัดเจน

Look att my homepage: ปั่น like facebook

โพสต์นี้ ให้ความรู้ดี สำหรับ คนที่ สนใจ ปั่น fajpage ดูแล้ว รู้วิธีทำมากขึ้น ชัดเจน

Feel free to visit my site; ปั่น like facebook

บทความนี้ อธิบายได้เข้าใจง่าย โดยเฉพาะ คนที่

กำลังเริ่ม ปั่น fanpage ศึกษาแล้ว ได้ไอเดียใหม่ๆ พอสมควร

Also visit my web site: ปั้มผู้ติดตาม facebook

เนื้อหานี้ มีประโยชน์มาก สำหรับ คนที่ สนใจ เพิ่มการมองเห็น fanpage ดูแล้ว รู้วิธีทำมากขึ้น

ชัดเจน

Look into myy website :: ปั่น like แฟนเพจ

บทความนี้ ให้ความรู้ดี โดยเฉพาะ คนที่ กำลังเริ่ม

เพิ่มการมองเห็น fanpage ศึกษาแล้ว ได้ไอเดียใหม่ๆ ชัดเจน

Have a look at my webpage; ปั่น like แฟนเพจ

โพสต์นี้ ให้ความรู้ดี เหมาะกับ คนที่ กำลัง ปั่น fanpage ศึกษาแล้ว เข้าใจแนวทางมากขึ้น

ชัดเจน

Feel fre too suff to my web site: เพิ่มผู้ติดตาม facebook

โพสต์นี้ อธิบายได้เข้าใจง่าย สำหรับ คนที่ กำลัง เพิ่มการมองเห็น fanpage ศึกษาแล้ว ได้ไอเดียใหม่ๆ แน่นอน

Feel free to surdf to my blog post: ปั้มผู้ติดตาม facebook

โพสต์นี้ มีประโยชน์มาก โดยเฉพาะ คนที่

สนใจ ปั่น fanpage ศึกษาแล้ว ได้ไอเดียใหม่ๆ

พอสมควร

My blog … ปั่น like แฟนเพจ

อ่านแล้วได้ไอเดียเพียบเลย,

ผมเพิ่งลองหาดู

ร้านขายดอกไม้ใกล้บ้านราคาประหยัด

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ผมใช้บริการแล้วประทับใจสุดๆ

Also visit my site :: ร้านขายดอกไม้ใกล้ฉัน

เนื้อหานี้มีประโยชน์มาก โดยเฉพาะ คนที่ กำลัง ปั่น

fanpage อ่านแล้ว ได้ไอเดียใหม่ๆ แน่นอน

Alsso visit my web page ปั่น like แฟนเพจ

บทความนี้ มีประโยชน์มาก โดยเฉพาะ คนที่ กำลังเริ่ม เพิ่มการมองเห็น fanpage ดูแล้ว รู้วิธีทำมากขึ้น แน่นอน

my web-site ปั่น like facebook

โพสต์นี้ ให้ความรู้ดี โดยเฉพาะ คนที่ กำลังเริ่ม ปั่น fanpage อ่านแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

My blog post :: ปั้นแฟนเพจ

บทความนี้ ให้ความรู้ดี โดยเฉพาะ คนที่ กำลังเริ่ม ปั่น

fanpage ศึกษาแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

My blog: ปั้มผู้ติดตาม facebook

บทความนี้ ให้ความรู้ดี โดยเฉพาะ คนที่ กำลังเริ่ม

เพิ่มการมองเห็น fanpage

ดูแล้ว รู้วิธีทำมากขึ้น แน่นอน

My page :: ปั่น like facebook

โพสต์นี้ อธิบายได้เข้าใจง่าย สำหรับ คนที่ กำลังเริ่ม ทำ faanpage ให้โต ดูแล้ว เข้าใจแนวทางมากขึ้น พอสมควร

Here is my web-site; ปั้นแฟนเพจ

เนื้อหานี้ อธิบายได้เข้าใจง่ายสำหรับ คนที่ สนใจ เพิ่มการมองเห็น fanpage ดูแล้ว รู้วิธีทำมากขึ้น พอสมควร

Here is my blog – ปั้นแฟนเพจ

บทความนี้ดีมากเลยครับ,

ตอนนี้ผมก็สนใจเรื่องนี้อยู่เลย

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

เหมาะกับคนที่อยากได้ของขวัญราคาย่อมเยา.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ผมใช้บริการแล้วประทับใจสุดๆ

Feel free to surf to my web-site ร้านขายดอกไม้ใกล้ฉัน

บทความนี้ ให้ความรู้ดี โดยเฉพาะ คนที่ สนใจ เพิ่มการมองเห็น fanpage ศึกษาแล้ว ได้ไอเดียใหม่ๆ ชัดเจน

Feel free to visit my website :: ปั้มผู้ติดตาม facebook

บทความนี้ อธิบายได้เข้าใจง่าย สำหรับ คนที่

กำลัง ทำ fanpage ให้โต ดูแล้ว

เข้าใจแนวทางมากขึ้น ชัดเจน

my blog – ปั่น like แฟนเพจ

เนื้อหานี้ มีประโยชน์มาก เหมาะกับ คนที่ สนใจ เพิ่มการมองเห็น fanpage

อ่านแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

Feel free to visit my web page :: เพิ่มผู้ติดตาม facebook

เนื้อหานี้ ให้ความรู้ดี โดยเฉพาะ

คนที่ กำลังเริ่ม ทำ fanpage ให้โต ศึกษาแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

Have a look at my site – ปั่น like แฟนเพจ

โพสต์นี้ อธิบายได้เข้าใจง่าย เหมาะกับ

คนที่ สนใจ ทำ fanpage ให้โต

ศึกษาแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

Feel free to surf to my blog – ปั่น like facebook

เนื้อหานี้ อธิบายได้เข้าใจง่าย โดยเฉพาะ คนที่

สนใจ ทำ fanpage ให้โต ดูแล้ว เข้าใจแนวทางมากขึ้น พอสมควร

Feel free to surf to my site :: ปั้มผู้ติดตาม facebook

โพสต์นี้ ให้ความรู้ดี เหมาะกับ คนที่ กำลัง ทำ fanpage ให้โต อ่านแล้ว ได้ไอเดียใหม่ๆ

ชัดเจน

Here iis my blog – ปั่น like facebook

เนื้อหานี้ ให้ความรู้ดี โดยเฉพาะ คนที่ สนใจ เพิ่มการมองเห็น fasnpage ดูแล้ว ได้ไอเดียใหม่ๆ พอสมควร

Also visit my web blog … ปั้มผู้ติดตาม facebook

โพสต์นี้ ให้ความรู้ดี สำหรับ

คนที่ สนใจ เพิ่มการมองเห็นfanpage อ่านแล้ว รู้วิธีทำมากขึ้น แน่นอน

Feel free to visit my webpage … ปั้นแฟนเพจ

เนื้อหานี้ มีประโยชน์มาก เหมาะกับ คนที่ กำลังเริ่ม ปั่น fanpage

ดูแล้ว รู้วิธีทำมากขึ้น ชัดเจน

Also visit myy web site; เพิ่มผู้ติดตาม facebook

บทความนี้ อธิบายได้เข้าใจง่าย สำหรับ คนที่ กำลัง ทำ fanpage ให้โต ดูแล้ว เข้าใจแนวทางมากขึ้น พอสมควร

my web-site … เพิ่มผู้ติดตาม facebook

โพสต์นี้ มีประโยชน์มาก สำหรับ คนที่ สนใจ ทำfanpage ให้โตศึกษาแล้ว

เข้าใจแนวทางมากขึ้น พอสมควร

my web-site – ปั่น like facebook

เนื้อหานี้ ให้ความรู้ดี โดยเฉพาะ คนที่ กำลังเริ่ม ทำ fanpage ให้โต

ดูแล้ว ได้ไอเดียใหม่ๆ

พอสมควร

Look at my web blog :: ปั่น like facebook

เนื้อหานี้ ให้ความรู้ดี เหมาะกับ คนที่ กำลังเริ่ม เพิ่มการมองเห็น fanpage อ่านแล้ว รู้วิธีทำมากขึ้น พอสมควร

Feel free to sjrf to my webpage … เพิ่มผู้ติดตาม facebook

เนื้อหานี้ ให้ความรู้ดี สำหรับ คนที่

กำลัง ปั่น fanpage ดูแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

Also visit my web blog – ปั้นแฟนเพจ

โพสต์นี้ มีประโยชน์มาก สำหรับ คนที่ กำลัง ทำ fanpage ให้โต อ่านแล้ว

เข้าใจแนวทางมากขึ้น แน่นอน

My siite … ปั่น like facebook

บทความนี้ ให้ความรู้ดี เหมาะกับ คนที่สนใจ ทำ fanpage ให้โต ศึกษาแล้ว รู้วิธีทำมากขึ้น แน่นอน

my web-site ปั่น like แฟนเพจ

โพสต์นี้ มีประโยชน์มาก สำหรับ คนที่ กำลัง

ทำ fanpage ให้โต อ่านแล้ว เข้าใจแนวทางมากขึ้น พอสมควร

my blog post :: ปั้มผู้ติดตาม facebook

โพสต์นี้ มีประโยชน์มาก สำหรับ คนที่ กำลัง ทำ fanpage ให้โต ดูแล้ว รู้วิธีทำมากขึ้น แน่นอน

Feel free to visit my web-site; เพิ่มผู้ติดตาม facebook

โพสต์นี้ ให้ความรู้ดี โดยเฉพาะ คนที่ กำลัง ปั่น fanpage ศึกษาแล้ว

เข้าใจแนวทางมากขึ้น แน่นอน

my page …ปั้นแฟนเพจ

บทความนี้ มีประโยชน์มาก สำหรับ คนที่ สนใจ ทำ fanpage

ให้โต ศึกษาแล้ว รู้วิธีทำมากขึ้น แน่นอน

Also viwit my blog post ปั้มผู้ติดตาม facebook

เนื้อหานี้ อธิบายได้เข้าใจง่าย โดยเฉพาะ

คนที่ กำลัง ปั่น fanpage ดูแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

My blog; ปั่น like facebook

โพสต์นี้ มีประโยชน์มาก สำหรับ คนที่ กำลังเริ่ม ทำ fanpage ให้โต ศึกษาแล้ว รู้วิธีทำมากขึ้น

แน่นอน

Feel free to surf tto myy blog post: ปั้นแฟนเพจ

เนื้อหานี้ มีประโยชน์มาก โดยเฉพาะ คนที่ สนใจ ปั่น fanpage อ่านแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

Feel free to surf to mmy site: ปั่น like แฟนเพจ

บทความนี้ อธิบายได้เข้าใจง่าย

เหมาะกับ คนที่สนใจ ปั่น fnpage ศึกษาแล้ว

ได้ไอเดียใหม่ๆ ชัดเจน

My web blog; ปั้นแฟนเพจ

บทความนี้ อธิบายได้เข้าใจง่าย โดยเฉพาะ คนที่ กำลังเพิ่มการมองเห็น

fanpage ดูแล้ว ได้ไอเดียใหม่ๆ

พอสมควร

my web-site: ปั้นแฟนเพจ

เนื้อหานี้ อธิบายได้เข้าใจง่าย

โดยเฉพาะ คนที่ กำลัง ปั่น fanpage ดูแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

my blog post :: ปั่น like facebook

เนื้อหานี้ อธิบายได้เข้าใจง่าย สำหรับ คนที่ กำลัง ปั่น fanpage อ่านแล้ว รู้วิธีทำมากขึ้น แน่นอน

my blog pkst ปั้มผู้ติดตาม facebook

บทความนี้ อธิบายได้เข้าใจง่าย โดยเฉพาะ คนที่ สนใจ ทำ fanpage

ให้โต ดูแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

Also visit my homepage ปั้มผู้ติดตาม facebook

โพสต์นี้ มีประโยชน์มาก สำหรับ คนที่ กำลัง เพิ่มการมองเห็น fanpage ดูแล้ว

รู้วิธีทำมากขึ้น พอสมควร

Take a look at my web site: เพิ่มผู้ติดตาม facebook

บทความนี้ ให้ความรู้ดี โดยเฉพาะ คนที่

กำลัง ปั่น fanpage อ่านแล้ว

รู้วิธีทำมากขึ้น พอสมควร

Here iss my webplage … ปั่น like แฟนเพจ

บทความนี้ ให้ความรู้ดี สำหรับ คนที่ สนใจ ทำ fanpage ให้โต ศึกษาแล้ว ได้ไอเดียใหม่ๆ

แน่นอน

Herre is my web page; ปั่น like facebook

โพสต์นี้ อธิบายได้เข้าใจง่าย สำหรับ คนที่ สนใจ ทำ fanpage ให้โต อ่านแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

My webb page … ปั้นแฟนเพจ

บทความนี้ อธิบายได้เข้าใจง่าย เหมาะกับ คนที่

กำลังเริ่ม ปั่น fanpage อ่านแล้ว รู้วิธีทำมากขึ้น ชัดเจน

Have a look at mmy blog post: ปั่น like แฟนเพจ

โพสต์นี้ มีประโยชน์มาก สำหรับ คนที่ กำลัง เพิ่มการมองเห็น

fanpage ศึกษาแล้ว เข้าใจแนวทางมากขึ้น พอสมควร

Here is my web page :: ปั้นแฟนเพจ

บทความนี้ ให้ความรู้ดี สำหรับ คนที่ กำลังเริ่ม ปั่น fanpage ดูแล้ว เข้าใจแนวทางมากขึ้น

แน่นอน

Also visit my page … ปั่น like แฟนเพจ

บทความนี้ ให้ความรู้ดี สำหรับ คนที่ กำลังเริ่ม เพิ่มการมองเห็น fanpage ศึกษาแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

my page: ปั้มผู้ติดตาม facebook

เนื้อหานี้ อธิบายได้เข้าใจง่าย สำหรับ

คนที่ สนใจ ปั่น

fanpagve ดูแล้ว รู้วิธีทำมากขึ้น แน่นอน

Also visit my web-site – ปั้มผู้ติดตาม facebook

เนื้อหานี้ มีประโยชน์มาก โดยเฉพาะ คนที่ กำลัง

เพิ่มการมองเห็น fanpage

ศึกษาแล้ว รู้วิธีทำมากขึ้น แน่นอน

Here is my web blog … ปั่น like แฟนเพจ

เนื้อหานี้ อธิบายได้เข้าใจง่าย เหมาะกับ

คนที่ กำลังเริ่ม ทำ fanpage ให้โต ดูแล้ว รู้วิธีทำมากขึ้น

แน่นอน

Review my web site; ปั่น like แฟนเพจ

บทความนี้ อธิบายได้เข้าใจง่าย สำหรับ คนที่

สนใจ ปั่น fanpage ศึกษาแล้ว ได้ไอเดียใหม่ๆ ชัดเจน

Feel free to surf to my blog post ปั้นแฟนเพจ

เนื้อหานี้ อธิบายได้เข้าใจง่าย เหมาะกับ คนที่ สนใจ ปั่น fanpage ศึกษาแล้ว รู้วิธีทำมากขึ้น พอสมควร

myblog post ปั่น like แฟนเพจ

บทความนี้ มีประโยชน์มาก สำหรับ คนที่ สนใจ ปั่น fanpage ดูแล้ว ได้ไอเดียใหม่ๆ แน่นอน

Heere is my webpage … ปั้นแฟนเพจ

เนื้อหานี้ อธิบายได้เข้าใจง่าย เหมาะกับ คนที่

กำลัง เพิ่มการมองเห็น fanpage ดูแล้ว

รู้วิธีทำมากขึ้น พอสมควร

Also visit my website: ปั่น like แฟนเพจ

เนื้อหานี้ ให้ความรู้ดี สำหรับ คนที่ กำลังเริ่ม ทำ fanpage ให้โต ศึกษาแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

My page :: ปั้นแฟนเพจ

โพสต์นี้ อธิบายได้เข้าใจง่าย โดยเฉพาะ

คนที่ กำลัง ปั่น fanpage ดูแล้ว ได้ไอเดียใหม่ๆ พอสมควร

My website :: เพิ่มผู้ติดตาม facebook

เนื้อหานี้ ให้ความรู้ดี สำหรับ คนที่ กำลัง ปั่น fanpage อ่านแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

Here is myy homepage – ปั่น like แฟนเพจ

เนื้อหานี้ อธิบายได้เข้าใจง่าย

โดยเฉพาะ คนที่ กำลังเริ่ม ปั่น fanpate อ่านแล้ว เข้าใจแนวทางมากขึ้น ชัดเจน

Also visit my site เพิ่มผู้ติดตาม facebook

บทความนี้ มีประโยชน์มาก สำหรับ คนที่ กำลังเริ่ม

เพิ่มการมองเห็น fanpage อ่านแล้ว

เข้าใจแนวทางมากขึ้น ชัดเจน

My blog poet – ปั่น like แฟนเพจ

เนื้อหานี้ ให้ความรู้ดี เหมาะกับ คนที่ กำลัง เพิ่มการมองเห็น fanpge ดูแล้ว รู้วิธีทำมากขึ้น แน่นอน

Look into my site … เพิ่มผู้ติดตาม facebook

บทความนี้ ให้ความรู้ดี โดยเฉพาะ คนที่ สนใจ

เพิ่มการมองเห็น fanpage อ่านแล้ว รู้วิธีทำมากขึ้น พอสมควร

Also visit myy web blog; ปั่น like แฟนเพจ

บทความนี้ มีประโยชน์มาก สำหรับ คนที่ กำลัง

ปั่น fanpage ดูแล้ว เข้าใจแนวทางมากขึ้น

ชัดเจน

Take a look at my blog post … เพิ่มผู้ติดตาม facebook

โพสต์นี้ อธิบายได้เข้าใจง่าย เหมาะกับ คนที่ กำลัง ทำ fanpage ให้โต อ่านแล้ว

เข้าใจแนวทางมากขึ้น ชัดเจน

my web page – ปั่น like แฟนเพจ

บทความนี้ อธิบายได้เข้าใจง่าย เหมาะกับ คนที่ กำลังเริ่ม เพิ่มการมองเห็น fanpage ศึกษาแล้ว เข้าใจแนวทางมากขึ้น

แน่นอน

Here is my site ปั่น like facebook

บทความนี้ ให้ความรู้ดี เหมาะกับ คนที่

กำลัง ปั่น fanpage ศึกษาแล้ว ได้ไอเดียใหม่ๆ แน่นอน

Herre is my web sire – เพิ่มผู้ติดตาม facebook

บทความนี้ มีประโยชน์มาก เหมาะกับ คนที่ กำลัง ทำ fanpage ให้โต อ่านแล้ว เข้าใจแนวทางมากขึ้น แน่นอน

Look into my site: ปั่น like facebook

My partner and I stumbled over here different web page and thought

I should check things out. I like whyat I seee sso now i’m following you.

Look forward tto looking innto your web page for a second time.

Take a look aat my page: ออกแบบโลโก้ฮวงจุ้ย

I was suuggested this blog by my cousin. I’m not sure wheter this polst is written byy him as nobody else know sch detailed about my problem.

You are incredible! Thanks!

Visit my wweb blog: รับออกแบบโลโก้ฮวงจุ้ย

ขอบคุณสำหรับข้อมูลดีๆนะครับ,

ผมเองก็กำลังมองหาอยู่เหมือนกัน

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

ราคาถูกกว่าที่อื่นแถมจัดสวยมาก

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ราคาถูกใกล้ฉัน.

ของจริงครับ บริการดีมาก

Stop byy my web-site :: Cmosa

เนื้อหาดี อ่านเพลินเลยครับ,

เมื่อเร็วๆนี้ผมลองค้นหา

ร้านขายดอกไม้ใกล้บ้านราคาประหยัด

และก็เจอเว็บที่น่าสนใจมากครับ!

บริการดีมาก ส่งไวจริง

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

ของจริงครับ บริการดีมาก

Look into my webpage … ร้านขายดอกไม้ใกล้ฉัน

Great post.

My blog: รับออกแบบโลโก้ ฮวงจุ้ย

I aam actually delighted to glancee at this blog posts which carries tons of

helpful data, thanks for providing these statistics.

My webb page :: รับออกแบบโลโก้ฮวงจุ้ย

เป็นโพสต์ที่มีประโยชน์มากจริงๆ,

ผมเพิ่งลองหาดู

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่ บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

ผมใช้บริการแล้วประทับใจสุดๆ

Here is my homepage – https://reskrimpolrestasorongkota.com/node/234774

อ่านแล้วได้ไอเดียเพียบเลย,

ผมเพิ่งลองหาดู

ร้านขายดอกไม้ใกล้บ้านราคาประหยัด

และก็เจอเว็บที่น่าสนใจมากครับ!

ราคาถูกกว่าที่อื่นแถมจัดสวยมาก

เหมาะกับคนที่อยากได้ของขวัญราคาย่อมเยา.

ลองเข้าไปดูได้ที่นี่ บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

ของจริงครับ บริการดีมาก

Here iis my website … ร้านขายดอกไม้ใกล้ฉัน

เนื้อหาดี อ่านเพลินเลยครับ,

เมื่อเร็วๆนี้ผมลองค้นหา

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

ราคาถูกกว่าที่อื่นแถมจัดสวยมาก

เหมาะกับคนที่อยากได้ของขวัญราคาย่อมเยา.

ลองเข้าไปดูได้ที่นี่ บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

รับรองไม่ผิดหวังแน่นอน

my web page; http://www.ezitec.CO.Kr

ขอบคุณสำหรับข้อมูลดีๆนะครับ,

เมื่อเร็วๆนี้ผมลองค้นหา

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่

ร้านดอกไม้ใกล้ฉันราคาถูก.

รับรองไม่ผิดหวังแน่นอน

Feel free to surf to my webb site … ร้านขายดอกไม้ใกล้ฉัน

Can you tell uus more about this? I’d care too find out

more details.

My web blog: ออกแบบโลโก้ ฮวงจุ้ย

อ่านแล้วได้ไอเดียเพียบเลย,

ตอนนี้ผมก็สนใจเรื่องนี้อยู่เลย

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

บริการดีมาก ส่งไวจริง

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

รับรองไม่ผิดหวังแน่นอน

my web-site Reda

บทความนี้ดีมากเลยครับ,

เมื่อเร็วๆนี้ผมลองค้นหา

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

มีให้เลือกหลายแบบตามโอกาส

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ราคาถูกใกล้ฉัน.

ของจริงครับ บริการดีมาก

Also visit my web site … ร้านขายดอกไม้ใกล้ฉัน

อ่านแล้วได้ไอเดียเพียบเลย,

เมื่อเร็วๆนี้ผมลองค้นหา

ร้านขายดอกไม้ใกล้บ้านราคาประหยัด

และก็เจอเว็บที่น่าสนใจมากครับ!

บริการดีมาก ส่งไวจริง

เหมาะกับคนที่อยากได้ของขวัญราคาย่อมเยา.

ลองเข้าไปดูได้ที่นี่ บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

รับรองไม่ผิดหวังแน่นอน

Herre is my blog post :: Vanessa

บทความนี้ดีมากเลยครับ,

ตอนนี้ผมก็สนใจเรื่องนี้อยู่เลย

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

ราคาถูกกว่าที่อื่นแถมจัดสวยมาก

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ดอกไม้สวยสดและราคาคุ้มสุดๆเลยครับ!

Allso visit my webpage :: ร้านขายดอกไม้ใกล้ฉัน

เนื้อหาดี อ่านเพลินเลยครับ,

เมื่อเร็วๆนี้ผมลองค้นหา

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ดอกไม้สวยสดและราคาคุ้มสุดๆเลยครับ!

my web page ร้านขายดอกไม้ใกล้ฉัน

เป็นโพสต์ที่มีประโยชน์มากจริงๆ,

เมื่อเร็วๆนี้ผมลองค้นหา

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ของจริงครับ บริการดีมาก

Look nto my website ร้านขายดอกไม้ใกล้ฉัน

เนื้อหาดี อ่านเพลินเลยครับ,

เมื่อเร็วๆนี้ผมลองค้นหา

ร้านขายดอกไม้ใกล้บ้านราคาประหยัด

และก็เจอเว็บที่น่าสนใจมากครับ!

บริการดีมาก ส่งไวจริง

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่

บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

รับรองไม่ผิดหวังแน่นอน

Review my blog post :: Cmosa

เนื้อหาดี อ่านเพลินเลยครับ,

ผมเพิ่งลองหาดู

ร้านขายดอกไม้ใกล้บ้านราคาประหยัด

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

เหมาะทั้งวันเกิดและงานแต่งเลย.

ลองเข้าไปดูได้ที่นี่ บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

ผมใช้บริการแล้วประทับใจสุดๆ

My web blog … ร้านขายดอกไม้ใกล้ฉัน

บทความนี้ดีมากเลยครับ,

ผมเพิ่งลองหาดู

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

มีให้เลือกหลายแบบตามโอกาส

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่

บริการจัดดอกไม้ใกล้คุณราคาดีสุด.

ผมใช้บริการแล้วประทับใจสุดๆ

Here is my homepage :: ร้านขายดอกไม้ใกล้ฉัน

บทความนี้ดีมากเลยครับ,

ผมเพิ่งลองหาดู

บริการจัดช่อดอกไม้ราคาถูกในพื้นที่ของผม

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

รับรองไม่ผิดหวังแน่นอน

Feel free to visit my web blog Hung

เป็นโพสต์ที่มีประโยชน์มากจริงๆ,

ตอนนี้ผมก็สนใจเรื่องนี้อยู่เลย

ร้านขายดอกไม้ใกล้บ้านราคาประหยัด

และก็เจอเว็บที่น่าสนใจมากครับ!

บริการดีมาก ส่งไวจริง

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

รับรองไม่ผิดหวังแน่นอน

Here is my blog: Cmosa

บทความนี้ดีมากเลยครับ,

ผมเพิ่งลองหาดู

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

ราคาถูกกว่าที่อื่นแถมจัดสวยมาก

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่ ร้านดอกไม้ใกล้ฉันราคาถูก.

ผมใช้บริการแล้วประทับใจสุดๆ

My site: ร้านขายดอกไม้ใกล้ฉัน

บทความนี้ดีมากเลยครับ,

ผมเองก็กำลังมองหาอยู่เหมือนกัน

ร้านดอกไม้ใกล้ฉัน ราคาถูก

และก็เจอเว็บที่น่าสนใจมากครับ!

เขามีดอกไม้สดใหม่ทุกวัน

ใครชอบเซอร์ไพรส์คนพิเศษต้องลองดูครับ.

ลองเข้าไปดูได้ที่นี่

ร้านดอกไม้ใกล้ฉันราคาถูก.

ดอกไม้สวยสดและราคาคุ้มสุดๆเลยครับ!

Herre is my site: ร้านขายดอกไม้ใกล้ฉัน